June is here, the New York skyline looks like a sci-fi hellscape, and we have some deeper thoughts on the state and future of community banking. This week we have a framework for bringing generative AI into your organization and a look at the threat to banking relevance from embedded finance.

1. Planning for generative AI for banking

The banking team at Accenture presents a framework for getting started with generative AI. But why now, you might ask?

Today, the question for banks isn’t whether generative AI will profoundly impact their industry, but how. And how will they take advantage of this massive opportunity to capture value?

The imperative isn’t about being a leader in the space or rushing out with new solutions. It’s about being prepared with a strategy and vision and understanding how to increase the chance of success going forward.

There will also be critical decisions made around AI partnerships. Databricks released the code for an open-source LLM called Dolly, and its site explains that this tool enables a company to “build its own LLM model rather than sending data to a centralized LLM provider”. This would allow the company to meet its “specific needs for model quality, cost and desired behavior” and/or avoid sharing sensitive data with a third party.

The role of your data, your first-party data, cannot be overstated. And it is not about compliance. It’s about competitive advantage. From their linked presentation:

Companies need a strategic and disciplined approach to acquiring, growing, refining, safeguarding and deploying data.

Their punchline recommendations are very much along the lines many winning firms took with mobile 10-15 years ago. AI will likely change the way your institution functions. It will probably happen faster than you think. Make it a strategic item you need to address and have a plan for but without a clear path forward.

Taking advantage of this requires experimentation. It also requires an attitude and approach to foster that experimentation. It may not work. Learning from experiments is often more valuable than more tangible results.

To succeed, you must have a process for managing disruptive innovation aligned with the goals.

2. Embedded finance and how fintech is expanding into more banking functions

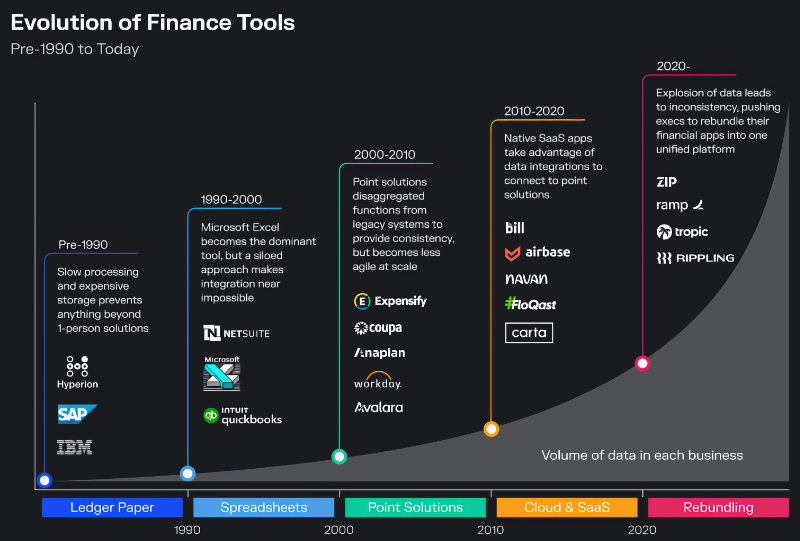

Contrary Research digs into the growing reliance of CFOs on fintech solutions. Megan Kao and Kat Orekhova present a view of the growing demands and shrinking talent pool for CFOs.

Across finance and accounting, companies are struggling to retain talent. Accountants and auditors in the US have left the field in droves, causing a 17% decline in these roles between 2020 and 2022, often due to retirement or burnout. In corporate finance, the quality of the talent pipeline has also taken a major hit.

With an expanding scope of responsibilities and increasingly limited headcount as a result of macroeconomic headwinds, CFOs in 2023 are feeling the pain of relying on legacy systems, which solve only a fraction of their evolving needs. Historically, finance teams would hire more analysts to do routine monthly and quarterly processes, but now they are actively exploring tools to automate these tasks and drive efficiency.

Instead of talent, business customers of all sizes, your customers, are increasingly turning to the growing collection of Fintech tools to solve these problems.

Many of these solutions supplant the role their primary banking used to provide. Payment, treasury, credit card/spend management.

The key trend that is driving renewed focus in this are from investors:

A large opportunity exists for vendors who can deeply embed themselves within finance and business workflows to deliver time savings, break down data silos, and ultimately empower finance and business leaders to operate better together.

It would be easy to look at this, throw up your arms, and declare you and your industry are a victim of technology. But there are other options.

Look at your customer relationship and your knowledge of your served markets. These are hard-earned, valuable, and unique to just you. If considered and leveraged, you can find many problems your customers have that you are uniquely positioned to solve.

Jan-Erik Asplund of Sacra presents a view of the Banking as a Service (BaaS) market and the potential banks of all sizes have in the right partnerships to solve those critical problems for their customers.

Banks, struggling to generate new sources of revenue amidst regulatory battles and digital transformation, have a new and fast-growing base of potential customers that need their charters.

It’s possible that we will see a world where for banks, building and maintaining their channel to their BaaS partners is as common and obvious as building and maintaining local branches to retain customers was in the 20th century.

Written in 2021, some of the trends identified haven’t played out, like Maqeta’s recent performance. However, the unit/customer economics and analysis is still valid. Winning in this market demands that you understand your current and potential position in the value or supply chain of services.

That’s it for this Friday. Innovation sometimes imagines a horrible and hilarious future (I think I could take Rhonda). Thoughts? Drop us a line at blog@mindspaninc.com.