Every week, we share a few stories on banking and data that caught our attention and maybe didn’t make the headlines.

This week, we look at survey results from McKinsey and Jack Henry on consumer behavior and preference, how that impacts where community banks and credit unions are focusing their strategy, and where they’re placing their investment bets in technology and innovation.

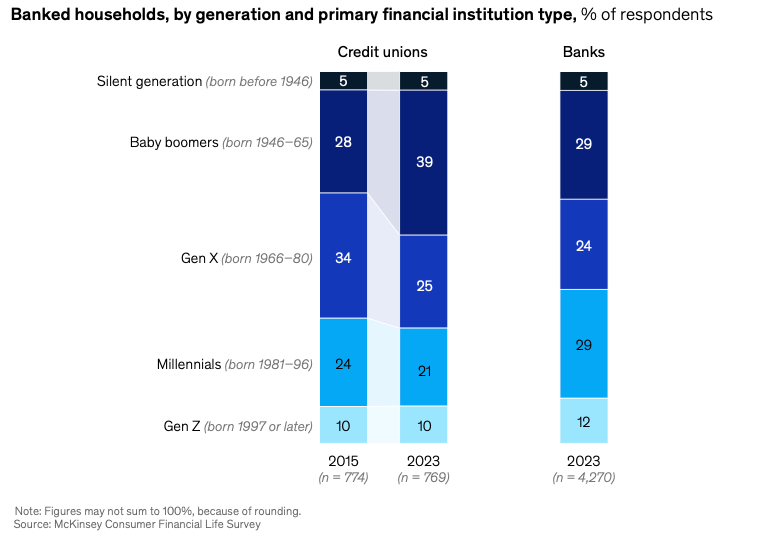

1. CUs losing edge with younger consumers

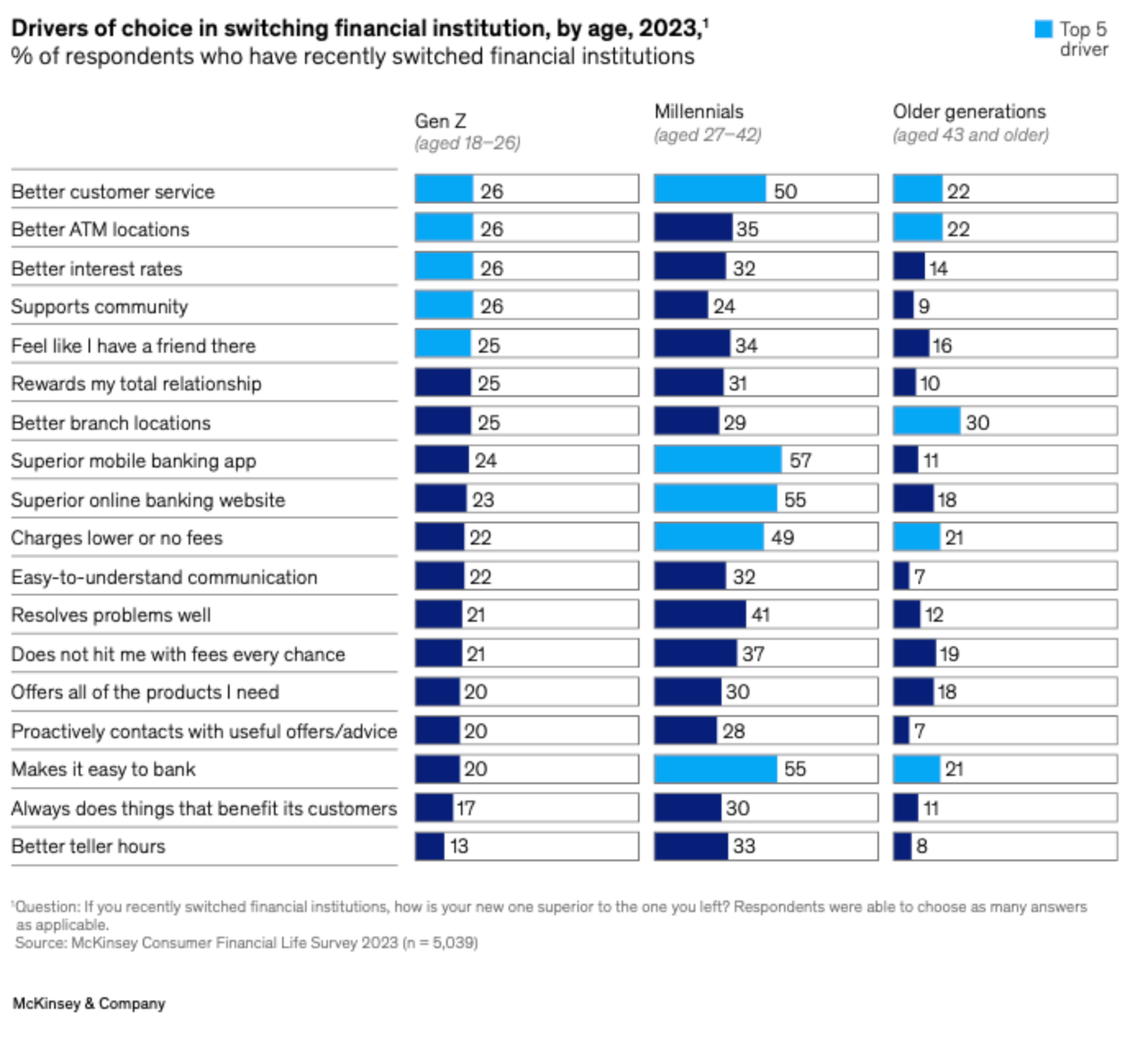

McKinsey released a study of general trends and recommended strategies for the perceived weakening position of the credit union market as a whole. The report starts with an analysis of generational differences in preferences for banking services.

In addition to additional consumer perception data, the punchline of the report are six recommendations for attracting millennial and Gen Z consumers:

- Point to credit unions’ history of commitment to social impact, a principle that appeals to many Gen Zers and millennials

- Meet younger consumers where they are namely, digital channels

- Invest in personalization and digital banking

- Upgrade core technology to enable digital strategies

- Use AI to improve the member experience

- Future-proof the business model through M&A and partnerships

Cornerstone Advisors’ Ron Shelvin presents this rebuttal:

These aren’t “strategies”–they’re “bromides” (defn: a trite and unoriginal idea or remark, typically intended to soothe or placate). What strategies should CUs pursue? Here are two contenders:

Make financial health and performance a core strategy. CUs can do this by: 1) making financial health and performance a product or service, and not just a resource; 2) measuring their members’ financial performance; and 3) taking a more holistic approach to health, i.e., addressing mental and physical health issues in addition to financial health issues.

2. Data comes front and center

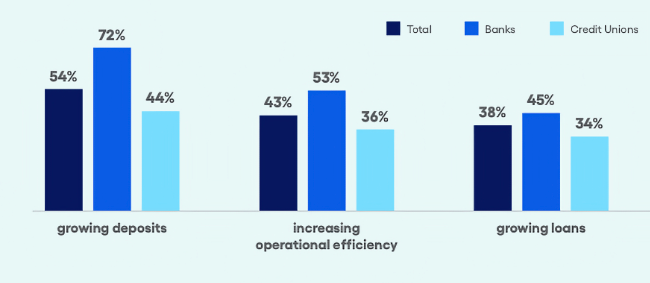

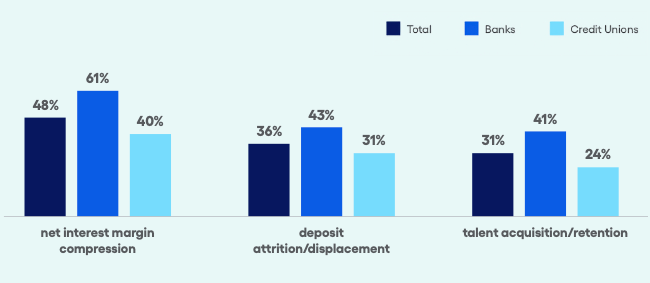

Jack Henry released their 2024 strategy benchmark, and the role of AI in making data even more useful and valuable as a competitive asset is the headline. Institutions share some commonalities in their top priorities and concerns.

The report shows less consensus and similarity in approach when it comes to technology spend, targeted market segments, and fintech partnerships. At the end though, all the levers rest on a common fulcrum.

Get Serious About Data Strategy Whether your top priority is growing deposits, improving efficiency, or preventing real-time fraud, all roads begin with data.

Achieving these priorities requires a coherent data strategy and a modern infrastructure necessary to execute that strategy.

Is your data accessible in real time? Do you have enough data to streamline digital account openings or do you need to tap open banking APIs and alternative data sources to fill gaps? Do you have the right data to automate the most inefficient back-office processes? Can your data train and tune a variety of GenAI language models that can dramatically improve service, loan decisioning, and fraud mitigation?

So ends the week and puts the 1st half of the year in the bag. The counter positioning in both report against the “too big to fail” is reminiscent of this classic Lilly Tomlin SNL sketch:

Click below to let us know how we did: