Every week, we highlight a couple of stories at the intersection of banking, data, and technology that either fell through the cracks or present a unique/contra view of the world.

This week (don’t click away yet), we’re looking at two trends in cryptocurrency, specifically stablecoins or tokens that are pegged to fiat currency. In these examples, it’s to the almighty USD, and their impacts on the Treasury and payments markets.

1. Stablecoins and Treasuries

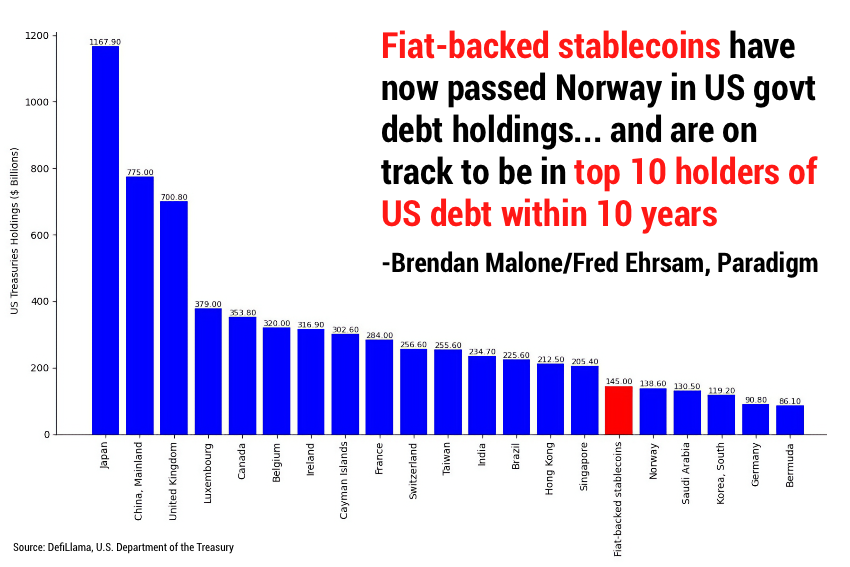

Ayo Kunle writes a fascinating analysis of how and why stablecoins are becoming the emerging home of US debt.

The world gets more multipolar/less integrated every day

China (and probably a bunch of other governments) are less interested in owning US Treasurys (and are thus buying more gold), which partially explains why Gold spot prices are at all time highs while ETF holdings of Gold are cratering.

Wealthy individuals in most developing countries will often move their excess savings to the US/UK/Europe. Cities like London, Vancouver and New York all have real estate markets that reflect this demand for dollar denominated assets. Non-wealthy individuals in developing countries really struggle to access USD, and have for decades, and as a result there’s pent up demand for it.

Basically, everyone around the world wants access to a relatively stable currency to denominate their savings in, one that has a predictable exchange rate vs. the goods and services they purchase every day. For most humans today (in 2024), dollars and euros are more stable than their home currency. A stablecoin backed by the dollar (or GBP, EUR, take your pick), is a permissionless way to do that.

Stablecoin driven demand for Treasurys will grow pretty linearly with underlying demand for stablecoins themselves.

So does the laying off of Treasuries by some bigger central banks mean bad news for the dollar?

Treasurys held in stablecoins that broadly distributed to retail, with some sliver of margin monetized by the “managers” of the stables, are far less usable in a weaponized way, versus their foreign central bank held counterparts.

The decoupling of U.S.-China and associated restructuring of capital flows, is often thought to be bad for USD dominance. However, the emergence of stablecoins bucks this trend and can end up reinforcing USD and treasurys dominance.

The whole article is worth reading to understand how geopolitical events like the war in Ukraine, cooling relations with China, and inconsistent regulatory treatment of crypto have all led to a new dynamic for the dollar. This may not be a concern for your institution’s balance sheet today, but tomorrow is a new day in a changing world.

2. Visa takes a back seat to stablecoin (maybe)

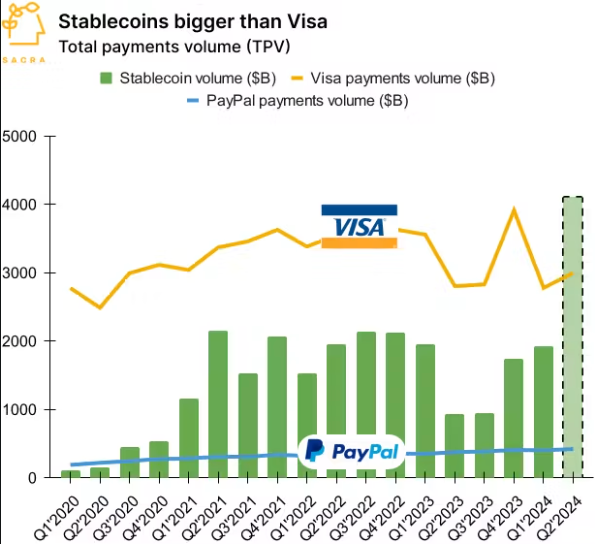

Jan-Erik Asplund of Sacra research writes on the sudden rise in transaction volume using stablecoin.

TL;DR: Stablecoins are on track to eclipse Visa (NYSE: V) on total payments volume (TPV) in Q2’2024.

Stablecoins have found extreme product-market fit in facilitating cross-border payments, with volume growing from $26 billion in January 2020 to $1.4 trillion in April 2024

Stablecoins win on convenience, enabling cross-border payments to be completed any day of the week (rather than business days only), on speed (in minutes rather than 6 to 9 hours), and cost ($0.0037 vs. $12), with volume split across Tether (47% of the market), DAI, (29% of the market), and USDC (24% of the market).

In addition to analysis, Sacra provides a ton of background research on how fintech payment platforms are gearing up to take advantage of this trend.

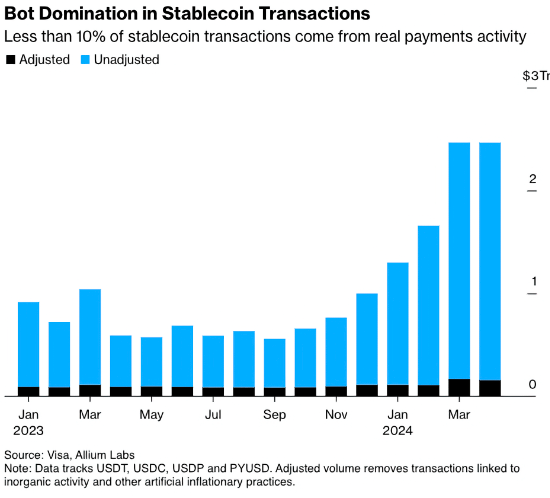

Visa quickly pushed back this week with a study questioning how much of the volume is “real”.

The dashboard from Visa and Allium Labs is designed to strip out transactions initiated by bots and large-scale traders to isolate those made by real people. Out of about $2.2 trillion in total transactions in April, just $149 billion originated from “organic payments activity,” according to Visa.

As to why Visa is being so vocal about this analysis….

Visa itself, which handled more than $12 trillion worth of transactions last year, is among companies that could stand to lose out should stablecoins become a generally accepted means of payment.

Caveat emptor on whether the tech VCs or payment networks have the right view. What is evident is that this is a growing element of how money flows in the world today. It’s enough for the four big US banks all allocating development $’s to have a stake in the market.

That’s it for this week. Who says romance is dead? Click below to let us know how we did: