It’s Friday, and as such, we share things we find worth sharing. This week, one piece that rose to the top of the list is a closer look at trust and its increasingly fleeting place in our modern society.

Ted Lamade, Managing Director at The Carnegie Institution for Science, shares an essay on this rare commodity, starting with a parable his father passed on many years ago to him and his brother.

“Imagine you have an empty bathtub and an eyedropper filled with water. How long do you think it would take to fill that bathtub if you added one drop at a time?”

Confused, and likely a bit scared, we replied, “Uhhh…a long time?”

My dad replied, “That’s right. A long, LONG time, but if you have enough time, you will eventually fill that tub.”

The two of us nodded in agreement as he continued,

“The same goes for trust. Each time you two do something trustworthy, you get to add a drop. Over time, those tiny drops accumulate until the bathtub is full. And, when the bathtub is full, you will have earned my trust.”

I remember thinking to myself, “Got it dad. Makes sense.”

But he wasn’t finished. His lesson had another leg to it,

“However, boys…when you do something that is significantly untrustworthy, you pull the plug and all that water you’ve earned over time goes down the drain.”

For many institutions in the U.S., the plug has been pulled.

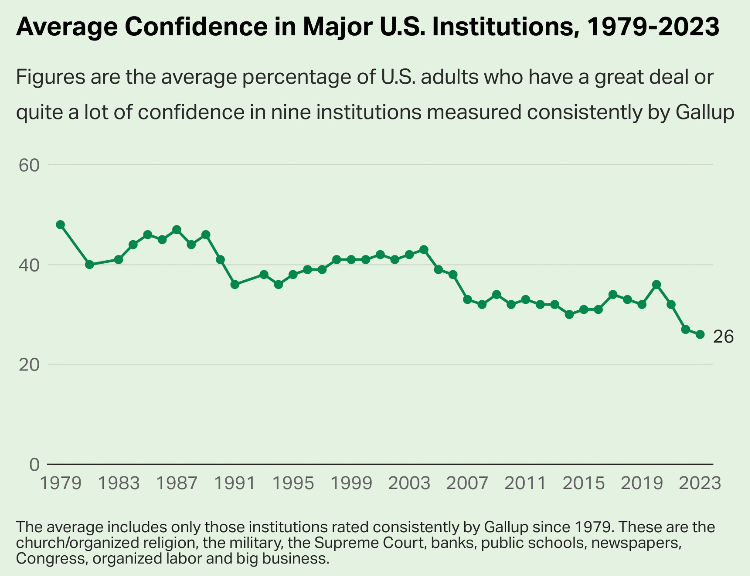

Gallop’s poll of public faith in U.S. institutions demonstrates the recent record lows in confidence people have in many institutions.

As an alternative to cynicism and techno-enhanced trust and verification, Lamand proposes a third option.

The good old-fashioned way — seeking out, following, partnering with, and investing in those who are committed to filling the bathtub gradually. This path requires identifying those who repeatedly do the right thing. These are the people willing to resist this new incentive structure centered around shorter attention spans and instantaneous feedback. These are the companies and investors who favor long-term compounding and are committed to staying the course, even if it means enduring periods that test even the most determined souls.

Surely this will require time and patience, but it will be worth it. Don’t believe me? Look no further than Charlie Munger’s philosophy on hiring,

“It is simple…trust first, ability second.”

This resonates directly with the criteria for picking a money manager that Munger got from Peter Kaufman:

I came up with what I call the five aces, five aces being the highest-hand of cards in a game of wildcard poker.

- Total integrity

- Actual deep, deep fluency in whatever you say you are going to do on behalf of the client

- A fee structure that’s actually fair in both directions

- An uncrowded investment space

- A long runway (meaning that the manager is reasonably young in age)

Returning to Lamade’s essay, while most of it points to the media and the lost status of news reporting, this seemingly inherent need for trust, transparency, and fidelity in how people are treated is sorely lacking in people’s lives. As with any unmet demand for a scarce item, it presents an opportunity.

Today, it feels like we are reaching an inflection point. I could be wrong, but it feels like people are tired of being lied to. Instead of airbrushed versions of life, they want to witness reality… They want to invest in companies and funds that are transparent, forthright, and aim to be around for decades instead of days. They want all the facts. They simply want the truth.

In short, they want people willing to fill the tub.

Community FIs have long traded in trust, implicitly and implied. It is a quickly appreciating asset that should be baked into your decision-making. It should impact everything from the minutia of terms and conditions to the look and feel of customer/member experience to the plainly stated promises of your brand. Trust is terribly difficult, time-consuming, and expensive to earn, but lost quickly in a moment of carelessness or thoughtless approach.

And that’s it for this Friday. Records can be weird, but apparently Guinness recognizes video game cable management. Click below to let us know how we did: