For this week, we have two views of the coming impact of AI on banking (and probably everything else). First, Accenture breaks apart the disruption of banking practices already seen by early AI adopters. Also, a look at the EU’s AI Act, and how it may be a blueprint for the inevitable legislation here in the US.

1. Accenture’s bold generative AI predictions for banking

Accenture has published research Banking in the age of generative AI. It’s not subtle. The headline:

Our latest financial projections indicate that the gains over the next three years will be substantial for the early adopters:

- 22% to 30% productivity improvement

- 600 bps rise in revenue growth

- 300 bps increase in return on equity

Serious claims. They base this on the disruption of the elements of banking that rely on conversation and written language communication.

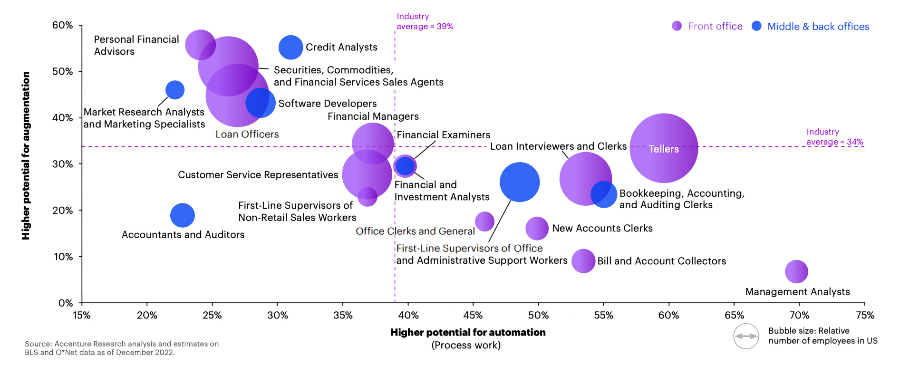

Banks are at the sharp end. Our analysis indicates that due to the importance of language throughout the value chain, the industry has a greater potential to benefit from the technology than any other. In fact, we concluded that 73% of the time spent by US bank employees has a high potential to be impacted by generative AI, 39% by automation, and 34% by augmentation. Only 27% of employees’ time currently has a low potential to be transformed. Similar metrics have been observed in banks worldwide.

There’s a lot of analysis, survey data, and examples in the full report, but the underlying assumption is that banking will undergo a wholesale change in how it functions in the next few years. Case in point is this look at how mortgage roles may change and where they believe less and more labor will be required:

The report ends with a detailed look at the next steps required to run ahead of the market and capture the advantages a differentiated approach affords.

Our conversations with industry front-runners reveal common themes. We see five key imperatives which C-suite executives should address to reinvent in the age of generative AI. We have also identified the key steps for each that will help your bank become a leader.

- Lead with value

- Understand and develop a secure AI-enabled digital core

- Reinvent talent and ways of working

- Close the gap on responsible AI

- Drive continuous reinvention

2. EU’s AI Act spokesman visits US

The Washington Post has a profile of Romanian European Parliament member Dragos Tudorache, who has been a high-profile leader in the EU’s passage of its AI Act. Lately, Turdorache has been making the rounds and advocating for their legislation to be a model for the rest of the world.

Tudorache is a member of the European Parliament from Romania and the chair of the Special Committee on Artificial Intelligence in a Digital Age. It’s hard to compare him to a current American politician because his chief personality trait is a passion for seriousness.

The European Parliament voted overwhelmingly to pass the AI Act last week, creating the first comprehensive set of rules for artificial intelligence. There are nits to pick, but the people I spoke with at big and small technology companies, as well as at citizens rights groups, were unanimous: Copy the homework

“I told everyone I met with in Washington, ‘Listen, of course, you will do your thinking, and you will make your decision as to the approach you want to take,’ ” Tudorache said. “ ‘We turned over exactly the stones that you’re turning over right now, and we think you will end up exactly where we are — not because we are smarter than everyone else but simply because we started earlier than everyone else.’”

Earlier, not smarter is a nice way of letting Congress save face.

Despite the sanguine attitude in the article, opinions vary. MIT Tech Review looks at the near-term requirements for companies operating in the EU. The law firm Burges Salmon presented this eye chart of analysis of the scope and impact that companies and public organizations in order to meet compliance requirements.

That’s it for this week. What makes an ideal playdate for a two year old? Why crows, of course. Click below to let us know how we did: