It’s another Friday, so we bring you a few of the news items that piqued our interest but didn’t make quite make all the headlines.

This week, the Treasury Department bickers with state legislatures over debanking and AML, and fintech continued to attract billions in investment last quarter.

1. States step into banking compliance

Richard Vanderford at the WSJ writes on the beef the Treasury has with states over “anti-debanking” laws design to protect citizens and business from blowback over politics, but may frustrate AML safeguards. Treasury officials specifically cited Florida’s recent legislation restricting the use of affiliations in risk assessment.

Banks need to be able to probe customers so they can prevent money laundering and counter terrorist financing, Treasury Undersecretary Brian Nelson said in a letter to lawmakers sent Thursday.

“State laws interfering with financial institutions’ ability to comply with national security requirements heighten the risk that international drug traffickers, transnational organized criminals, terrorists and corrupt foreign officials will use the U.S. financial system to launder money, evade sanctions and threaten our national security,” Nelson said.

Bloomberg’s Matt Levine, calls out the problem this creates for bankers. In context, he cites Deutsche Bank AG’s $150 million fine to New York banking authorities for letting Jeffrey Epstein have a checking account despite seeing “red flags” about his sex crimes.

I assume that if you are a bank and you think an account might belong to an Iranian government official or a drug trafficker, you will probably still be significantly more worried about the risk of keeping the account open than you are about the risk of closing it and getting a complaint. But now I guess there is a little bit of risk the other way.

2. Fintech investments slow but steady

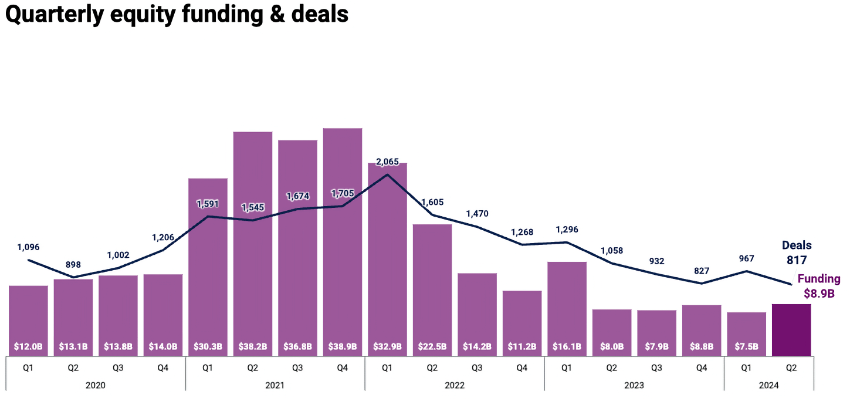

CBInsights published their Q2’24 state of Fintech report this week. Most notable is the decline in overall funding flowing into the fintech space (with AI taking a lot of oxygen out of the room, drawing over $18B in Q2, +32% QoQ).

19% Increase in funding, buoyed by two blockbuster deals. Global fintech funding rose in Q2’24 to $8.9B, up 19% quarter-over-quarter (QoQ). Yet, absent 2 late-stage deals for Stripe ($694M) and AlphaSense ($650M), funding would have remained flat. A 16% decline in deal volume also indicates fintech investors remain cautious.

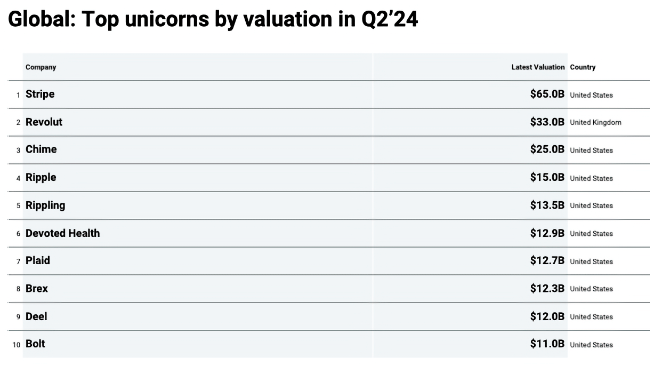

One note, of the 10 largest global private fintech firms, all but the UK neobank Revolut (which just received its UK banking license) are US firms.

Fintech company exits remained flat, with 162 transactions, mostly M&A, heavily weighted by market and investment tech deals. One exception was the $2.6B IPO of consumer rewards shopping app Ibotta.

There is more in the report on regional trends and the relative size of investors’ involvement. While the shiny new penny for investors is clearly in AI (and not mutually exclusive of fintech), plenty of capital is still in play in this space that represents a sizable option for innovation for institutions of all sizes. Keeping an eye here is a cheap way to glimpse into potential futures.

And that’s it for this Friday. In the vein of Americans’ preference for measuring in anything but metric, come this logic: “A gallon of gas has the same calories as 49 Big Macs, so a metro burns 1.2 Big Macs per mile.” Click below to let us know how we did: