This week, consulting firm EY released a comprehensive survey revealing the leading trends in how smaller institutions are approaching Generative AI adoption.

Key Findings

-

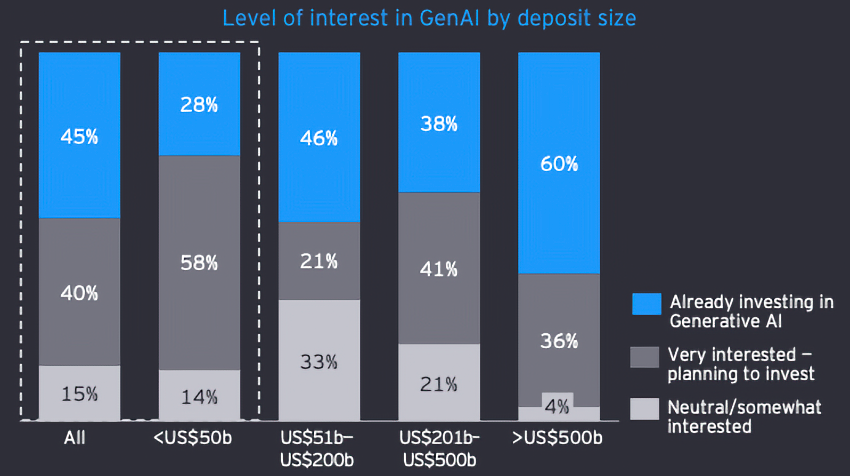

Investment Timeline: While only 28% of small banks have currently invested in GenAI (compared to 60% of large banks), 86% are either already or actively planning to invest, showing strong forward momentum.

-

Budget Allocation: Small banks are taking a measured approach, with 71% allocating less than 20% of their designated budget (typically from IT/tech spend) toward GenAI initiatives.

-

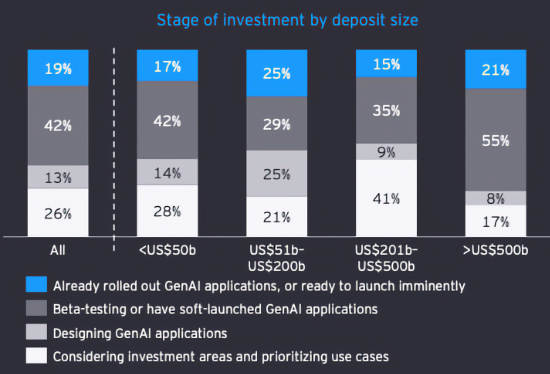

Implementation Timeline: 84% of small banks are launching GenAI applications by the end of 2024, though they lag behind larger institutions in speed-to-launch. Even the remaining 16% are targeting 2025 or later for inevitable deployment.

-

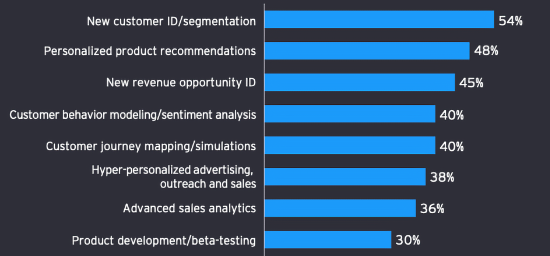

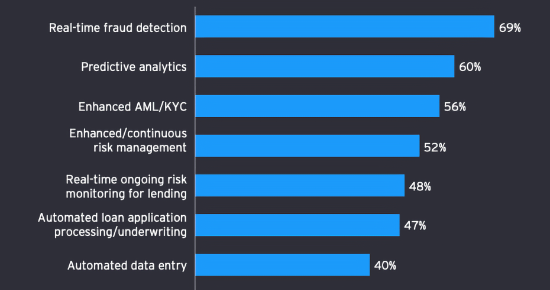

Priority Use Cases: Top focus areas include:

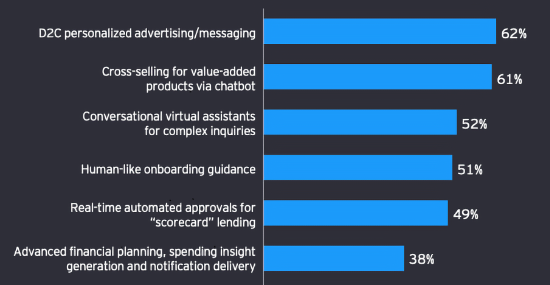

- Customer service enhancement (62% prioritizing)

- D2C personalized advertising/messaging (62%)

- Cross-selling via chatbots (61%)

- Real-time fraud detection (60%)

- Risk management automation (52%)

- Key Challenges: Primary barriers include insufficient internal expertise (cited by 55% of respondents), regulatory ambiguity, and cost constraints.

Summing Up

While smaller FIs may be moving more cautiously than their larger counterparts, they are showing a strong commitment to GenAI adoption with a clear focus on customer experience and risk management use cases. The primary challenge lies not in the willingness to adopt but in building the necessary expertise, navigating regulatory uncertainty, and developing clear ROI measurements that advance your institution’s goals.

That’s it for this week. Even with Halloween past, you can still get a scary look at these examples of architectural horror, the “Death Stairs”. Click below to let us know how we did: