It’s Friday, and so another look at a few of the things we read this week that we shared internally and didn’t get the attention in the headlines they deserve.

This week, we take a look at the external pressure on central banks, how that impacted the Bank of Japan, the CFPB takes aim at AI, and the veeeeeeery long-term CD.

1. The push for rate cuts

Former Pimco CEO Mohamed A. El-Erian, writes in a Bloomberg op-ed on how markets keep “bullying” central banks.

Due to “financial and capital markets at home and abroad being extremely volatile,” BoJ Deputy Governor Uchida noted early Wednesday that the central bank “needs to maintain monetary easing … for the time being.”

Bloomberg reported that hedge funds and other “fast money” accounts rushed to place new carry trades funded by the Japanese currency. The yen immediately spiked, appreciating by 2%.

The immediate market reaction to a new Bank of Japan policy signal illustrated, once again, the dilemma that central banks, led by the Federal Reserve, have created for themselves over two decades. While few central bankers seem willing to take the risk and play the role that Paul Volcker did in the early 1980s to break an inflationary spiral, all should be mindful of something that is as true today as it was then: Lasting financial stability requires genuine economic stability, and vice versa.

In related news, a few charts showing how this pressure takes form in the wild.

The Interest Expense on US Public Debt rose to a record $1.11 trillion over the last 12 months, more than doubling over the past two years. At the current pace it will soon be the largest line item in the Federal budget, surpassing Social Security.https://t.co/l5IYmkf6Ih pic.twitter.com/bKLKdzLnOT

— Charlie Bilello (@charliebilello) August 12, 2024

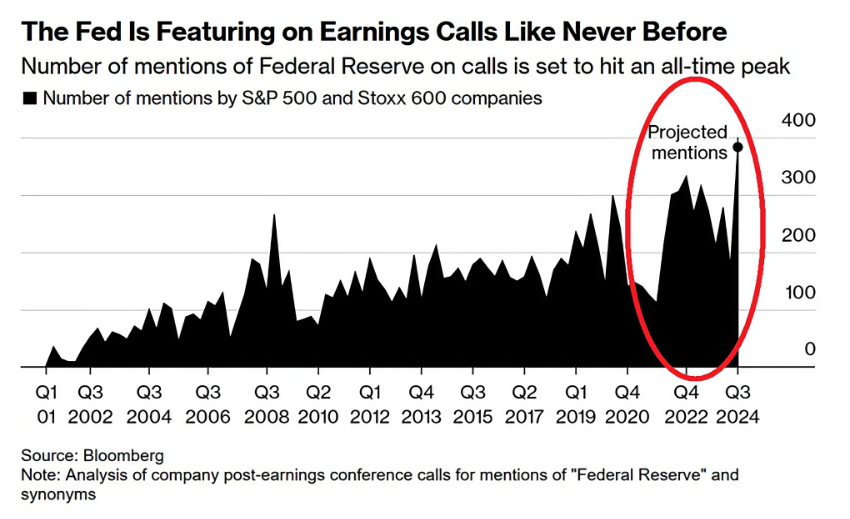

…and context on our header image above.

This is interesting:

— The Kobeissi Letter (@KobeissiLetter) August 12, 2024

The number of "Federal Reserve" mentions during the earnings conference calls is on track to hit a new record in Q2 2024.

It is estimated the Fed will be mentioned ~380 times during Q2 earnings calls, according to Bloomerg.

This would be more than TRIPLE… pic.twitter.com/ZgcouhRmgr

2. Fighting the AI ‘doom-loop’

Dan Ennis at Banking Dive covers the CFPB’s new target, chatbots. Like dark patterns, regulators are looking to thwart techniques to delay, confuse, and otherwise prevent customers from accomplishing tasks like canceling subscriptions or getting refunds. The effort is named the “Time is Money” proposal.

“Companies often deliberately design their business processes to be time-consuming or otherwise burdensome for consumers, in order to deter them from getting a rebate or refund they are due or canceling a subscription or membership they no longer want — all with the goal of maximizing profits,” the White House wrote in introducing what it dubbed the “Time Is Money” initiative. “Americans are tired of being played for suckers.”

The CFPB will identify when the use of automated chatbots or artificial intelligence voice recordings is unlawful, including when customers believe they are speaking with a person, the White House said.

“When people request basic information about their accounts, big banks cannot charge them massive fees or trap them in endless customer service loops,” CFPB Director Rohit Chopra told reporters last October.

Those loops, too, came back around in messaging Monday. The CFPB is set to float a rule requiring companies to let customers talk to a person by pressing a single button.

Considering the level of frustration in your user experience, particularly for digital channels, it is not only good business for the community FI but may soon fall under compliance.

2. The 100-Year CD

Kiplinger profiles a new offering from Walden Mutual Bank for a full century CD. The product is designed for donor-advised funds, trusts, and charitable giving strategies. Erin Bending at Kiplinger does the math.

With savings rates as high as they are, you’ve probably considered locking up your cash in a CD account for an extended period of time, say five years. But what about locking your cash away for a full century? With Walden Mutual Bank, you can now open a 100-year CD with a pretty solid savings rate of 4.75%. You’ll earn quite a lot in interest once the CD matures, but that’s more than a lifetime of waiting.

How much can you earn on a 100-year CD?

$1,000 deposit (minimum)

Earnings: $102,610.36

Total: $103,610.36

…

$150,000 deposit (maximum)

Earnings: $15,391,553.33

Total: $15,541,553.33

Does your institution offer less common and “weird” products like this? Drop a note or leave a comment with a link.

That’s a wrap for this Friday. To close it out, here’s a heartwarming story about a dog that caught not a car but a bus. -> also the video mentioned in the article. Click below to let us know how we did: