For community financial institutions already grappling with tech modernization and competitive pressures, this week’s CFPB announcement adds another layer of complexity to their strategic planning. The agency’s finalization of its Personal Financial Data Rights Rule represents a fundamental shift in how financial institutions must handle customer data – and smaller institutions need to start preparing now, despite seemingly distant deadlines.

The Core Changes

Let’s start with Bankingdive’s Dan Ennis summary of what’s actually changing:

The rule would require financial institutions, credit card issuers and other firms to transfer personal financial data to other providers for free at the consumer’s request. But while last year’s proposal applied to data linked to bank accounts, credit cards and mobile wallets, Tuesday’s final rule applies to payment apps, too.

The inclusion of payment apps is particularly significant for community institutions. As consumers increasingly rely on digital payment solutions, this expansion means your institution’s data-sharing obligations now extend beyond traditional banking relationships into the fintech ecosystem. This could either fragment your customer relationships or create opportunities for strategic partnerships.

The CFPB frames these changes as consumer-empowering measures. From their executive summary:

In giving consumers more control over their financial data, the Personal Financial Data Rights final rule will spur greater choice and increase competition by enabling people to:

- Fire fintechs and banks that provide lousy service

- Shop for better rates on products and credit

- Make secure payments, including with “pay-by-bank”

Reading between the lines, community institutions should note the emphasis on “pay-by-bank” capabilities. This signals the CFPB’s intent to foster direct bank-to-bank payment solutions that could potentially decrease reliance on card networks – a development that merits close attention from institutions heavily reliant on interchange revenue.

Implementation Timeline: A Mixed Blessing

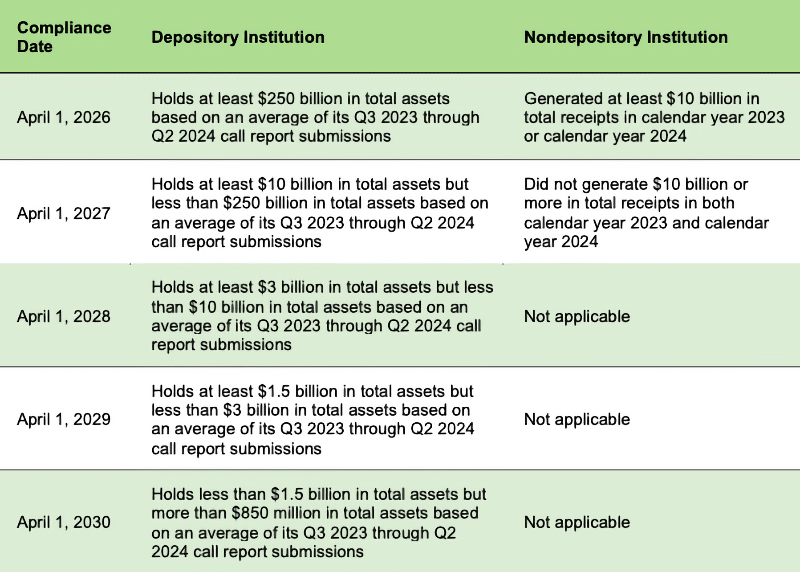

The extended compliance timeline – stretching to 2030 for smaller institutions – might seem like a reprieve, but it could actually put community FIs at a competitive disadvantage. Larger institutions will be offering these capabilities years earlier, potentially setting new consumer expectations well before smaller institutions must comply.

Legal Challenges Begin

Among widespread criticism from banking trade groups, and before the day was out, the new ruling met its first legal challenge

The Bank Policy Institute, the Kentucky Bankers Association and Forcht Bank filed a lawsuit Tuesday in the U.S. District Court for the Eastern District of Kentucky, charging the CFPB with overstepping its authority and asserting the rule would put consumers and the banking system at risk.

This legal challenge is particularly interesting given the recent Chevron doctrine changes. However, community institutions should avoid the temptation to wait and see how litigation plays out. The core principles of data portability and consumer control are likely here to stay, regardless of how specific provisions might be modified through legal challenges.

Finding the Opportunity

While many in the industry view these rules as purely burdensome, Accenture offers a more optimistic perspective):

While the regulatory changes might seem daunting, they present FIs with an opportunity to leverage Open Banking frameworks and create new revenue streams. By building out robust API platforms and partnering with fintechs, banks can offer consumers personalized financial insights and services that go beyond traditional banking products.

This is particularly relevant for community institutions. Your advantage has always been customer relationships and local market knowledge. Modern API infrastructure could allow you to maintain those relationships while offering the digital capabilities consumers increasingly expect.

Strategic Implications for Community FIs

No matter which tier of institution you fall into, the following provides a good short list of considerations to keep in mind for your strategic and investment planning in the next few years.

- Data Strategy Becomes Critical

- Audit your current data architecture

- Identify gaps in data governance

- Plan for real-time data access capabilities

- Technology Investment Planning

- Begin budgeting for API infrastructure

- Consider cloud migration strategies

- Evaluate current core provider capabilities

- Partnership Opportunities

- Assess potential fintech partnerships

- Explore shared technology solutions with peer institutions

- Consider joining industry consortiums

Looking Ahead

The CFPB’s rules fundamentally change the competitive landscape. Community institutions face a choice: view this as purely a compliance burden or seize it as an opportunity to modernize and enhance their service offerings. Those that choose the latter path – while being mindful of resource constraints and risks – will be better positioned for the future of banking. Success will require careful planning, strategic technology investments, and possibly new partnerships. But the alternative – falling behind on digital capabilities while larger competitors forge ahead – poses an even greater risk to community institutions’ long-term viability.

And that it for this Friday. Remember, no matter who you are or where you live…

Click below to let us know how we did: