It’s Friday, the first one in this closing month of summer, and with it, a few of the headlines and stories that caught our eye this week in the world of banking, tech, and other interesting fare.

Today, we have analysis of the growth in loans going to modification and a look to the past for any predictive power, and Maryland takes aim at pre-paid card fraud against consumers and how that might impact payment nationally.

1. Is it 2009 again?

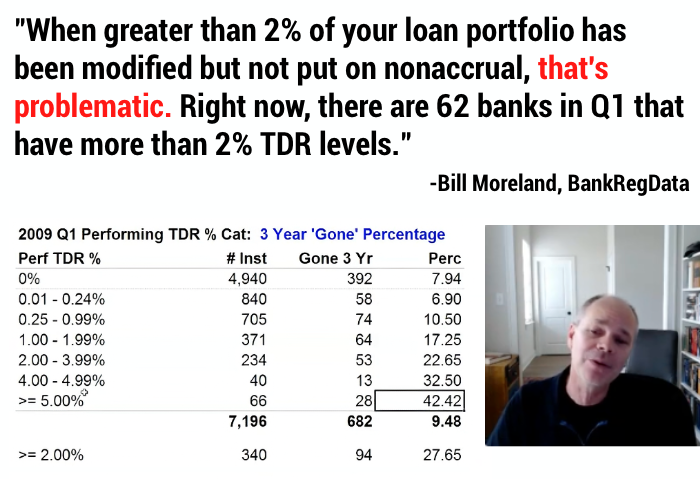

Bill Moreland of BankRegData presents this analysis of the growth in performing but modified loans, and to what extent is that a predictor of bank failure?

“If history repeats, it may repeat exactly, but it’ll rhyme. We should be looking at those banks with TDR > 2% and asking some hard questions. Because the expectation is that 25-30% of those banks will be gone in 2 years.”

2. Maryland law aims to reduce fraud

ProPublica’s Craig Silverman has a deep dive on a new state law that may have massive implications on retailers and financial organizations that run the pre-paid gift card programs for them.

Maryland Gov. Wes Moore recently signed the Gift Card Scams Prevention Act of 2024, creating the country’s first law aimed at curbing a rising form of gift card fraud called card draining.

Card draining is a scheme in which thieves remove gift cards from stores, capture their numeric codes or swap them out for counterfeit cards, and place the products back on display. When an unsuspecting customer loads money onto a tampered or counterfeit card, criminals access it online and steal the balance.

The Maryland law is the first in the nation to mandate secure packaging for most gift cards sold in person. The bill’s packaging requirements sparked industry pushback that at one point threatened the bill’s passage, according to Sen. Ben Kramer, the Maryland state senator who sponsored the legislation.

As for the reason MD lawmakers passed the law in April:

An estimated $570 billion is loaded onto gift and prepaid cards each year in the United States, Hirschfield said. While it’s difficult to know how much of that money has been stolen, even a 1% fraud rate would result in $5.7 billion in annual consumer losses, according to Hirschfield’s data.

One quarter of U.S. respondents said they had given or received a card with no balance, presumably because it had been stolen, according to a 2022 survey of about 2,000 adults by the AARP, the nonprofit advocacy group for people over age 50.

The article includes more on the lobbying efforts, the broader impacts on retailers nationwide, and a video showing the more detailed aspects of the packaging flaws and how the law aims to address the vulnerabilities.

That’s it for this first Friday in August. Have you been watching the Paris Olympics? The memes are on point. If you’re thinking about getting off the sideline, here’s a guide to what sport you could play based on your height and weight (I found myself about as far away from any sport in the chart as I physically am from Paris here in North Carolina).

Click below to let us know how we did: