Each week, we look at a couple of stories at the intersection of banking, data, and technology that may have been overlooked or offer a unique and contrarian perspective on the world.

This week, the Feds crack down on commercial mortgage fraud, and a look at the disappearing troubled loan in reporting data.

1. Cracks show in CRE

The WSJ reports on the uptick in criminal prosecutions of commercial mortgage fraud, which raises doubts about the integrity of valuations in the $4.7 trillion industry.

Regulators and federal prosecutors say that property loans based on doctored building financials and valuations have been rising. This type of fraud became more widespread between the mid-2010s and 2021, federal investigators and real-estate brokers say, when commercial property prices surged to new highs and landlords had much to gain from such maneuvers.

While data on the number of open investigations on real-estate fraud aren’t publicly available, a number of plea deals have been reached in recent months.

Since last fall, at least five different landlords of properties, mostly apartment buildings, in cities including Cincinnati, Hartford, Conn., and Little Rock, Ark., have pleaded guilty to federal fraud charges. Some allegedly doctored building income statements, others allegedly faked property sales at inflated prices, all to get bigger loans.

2. The vanishing restructured loan

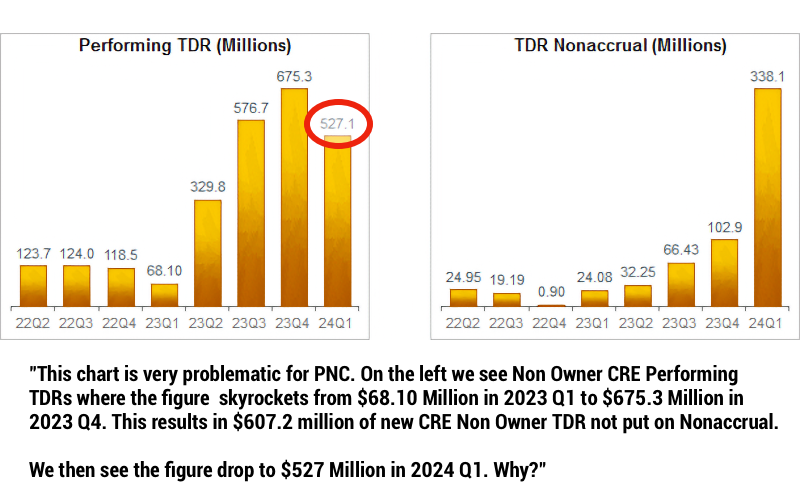

Bill Moreland at BankRegData has an analysis of the seemingly benign leading indicators of CRE stress.

TDR is Troubled Debt Restructuring and reflects loans that have had their terms modified to lower the borrower’s monthly payment. Modifications include lowering the rate, extending the repayment term and/or reducing principal.

Modified loans, as per FDIC guidelines, are typically put on Nonaccrual where the bank will not recognize future late fees or interest income. 100% of the payment goes to principal paydown. A ‘Performing’ TDR is not put on Nonaccrual and the bank continues to recognize income on future payments.

‘Performing’ TDR is a bit of misnomer since it implies the modified loan is a good, performing loan with no different risk profile than any other loan that is not delinquent. My experience at Wells Fargo is that this is far from the case. The 12-24 month charge off profile is considerably higher than the base portfolio - especially in a deeper or longer recessionary period.

Using PNC as an example, Bill presents a view of how the true extent of the deteriorating assets is being obscured by alternations to reporting definitions.

…The FDIC (after 3+ decades) changed the definition of TDR in 2023 Q1 to exclude any borrower who made 12 consecutive payments.

I absolutely do not like these new rules. What happens if the TDR loan pays for 12 months (since that was the goal of lowering the payment), goes off TDR classification and then goes delinquent again in Month 14?

I would have much preferred Call Report additions of TDR Maturity along with TDR Charge Offs. This would have been a much more enlightening way of gauging TDR effectiveness rather than moving backwards into a more opaque process.

I’m beginning to think the opaqueness is a feature and not a bug.

I suspect part of it was to remove from the public conscious the fact that we have an enormous amount of 1-4 Family loan modifications (primarily mortgages) in the bestest, greatest housing market of all time. This leads to some very uncomfortable policy discussions. The second motivating factor surely was the desire to reset the baseline for the massive TDR efforts that are currently taking place.

Potentially we are looking at an example of Occam’s Broom:

“The process in which inconvenient facts are whisked under the rug by intellectually dishonest champions of one theory or another. This is our first boom crutch, an anti-thinking tool, and you should keep your eyes peeled for it… the absence of a fact that has been swept off the scene by Occam’s Broom is unnoticeable except by experts.”

And that it for this Friday. There’s a new Pixar sequel out. Click below to let us know how we did: