Every week, we share a few stories in banking and data that caught our attention and maybe didn’t make the headlines.

This week a look at the softening of labor shortages and the surprising low cost to circumvent AML systems and incredible expense when it happens.

1. Labor market continues to cool

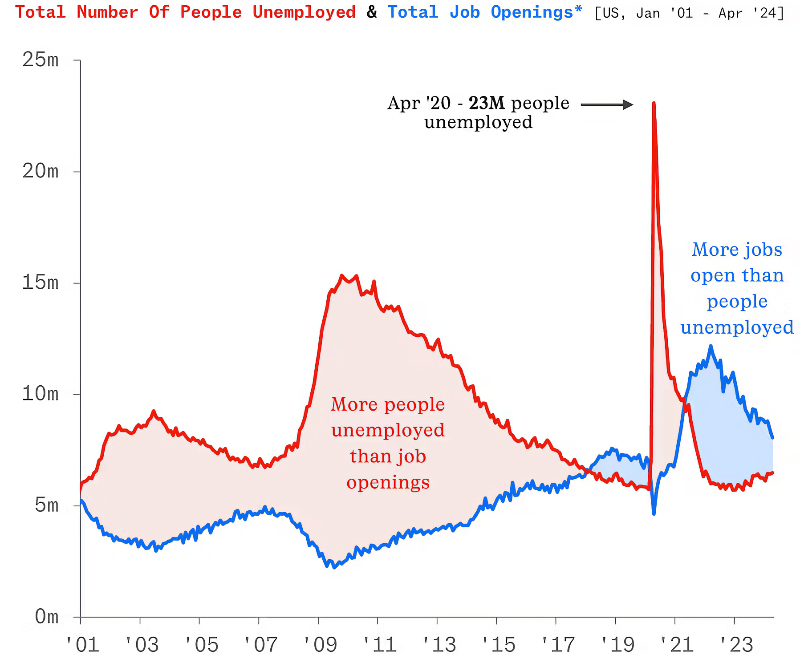

Robinhood’s Chartr provides this analysis of the Bureau of Labor Statistics (BLS) report on Job Opening and Labor Turnover Survey (JOLTS).

Looking to change up your job? There might not be as much choice as there was a couple of years ago. That’s the takeaway from national job openings data, which fell more than expected in April to the lowest level in over 3 years, according to the Bureau of Labor Statistics, as the labor market continues to show signs of cooling.

The new figures released yesterday showed that the number of available positions in the US for April was 8.06M — some ~300K less than the month prior — translating to 1.24 openings for every unemployed person, the smallest ratio recorded since June 2021 and down from a peak of 2:1 in 2022.

Bloomberg’s Jarrel Dillard adds:

The pullback was fairly broad. Vacancies in health care fell to the lowest in three years, while those for manufacturing dropped to the lowest since the end of 2020. Demand for government jobs also weakened.

Openings in accommodation and food services decreased as well, possibly reflecting California’s higher minimum wage requirements. Hiring in that industry fell to the lowest since the onset of the pandemic.

Recent data indicate the labor market is cooling, but it’s been gradual through slower hiring rather than outright job cuts. Fed officials hope that trend will continue in order to rein in demand and tame inflation without putting millions of people out of work.

2. AML can’t withstand $200 gift card

Banking Dive provides a rundown of the ongoing money laundering investigation of TD Bank. Details came out this week as part of a criminal case brought against a TD banker for conspiring to circumvent international transfer controls.

“Man, to me, this isn’t business. Honestly, I was thinking $200 per client with you guys,”

The criminal complaint, filed in the U.S. District Court for the District of New Jersey, comes during an ongoing Justice Department investigation into TD’s anti-money laundering practices. The investigation is expected to result in financial penalties of as much as $2 billion.

In Hollywood, Florida, now-former retail banker Gerardo Aquino Vargas allegedly provided services for criminals to send money to Colombia. Aquino Vargas allegedly provided one co-conspirator with at least 28 debit cards — netting Aquino Vargas $5,600 in bribes — and claimed that he charged them a lower rate than he charged others for the same illegal services.

The aforementioned ongoing DOJ investigation was spurred by a 2021 criminal case in which federal prosecutors charged New York City-based Da Ying Sze with coordinating a scheme that laundered at least $653 million in proceeds from illegal fentanyl.

The bank also disclosed that day, prior to the fentanyl report, that it would set aside $450 million to cover expected penalties from one U.S. regulator. It made clear that it anticipated “additional monetary penalties” which were “unknown and not reliably estimable at this time.”

The corollary in tech is the “$5 wrench attack”:

So ends this first week in June. You may be bad at math, but imagine getting a lifetime ban for betting on your own team but only winning 4.3% of the bets you placed. Click below to let us know how we did: