The week a look at the growing role energy and the financing behind it play in technology. Also, how data may play the ultimate role in the biggest winners of our current age.

1. “Everyone is now chasing power. They are willing to look everywhere for it.”

Much of the focus on AI-driven growth forecasts is on software (OpenAI) and the specialized hardware (Nvidia) required to deliver services. WaPo, however, has a look into the dynamics that are leading to land rushes far away from the tech-centric hubs on the coasts.

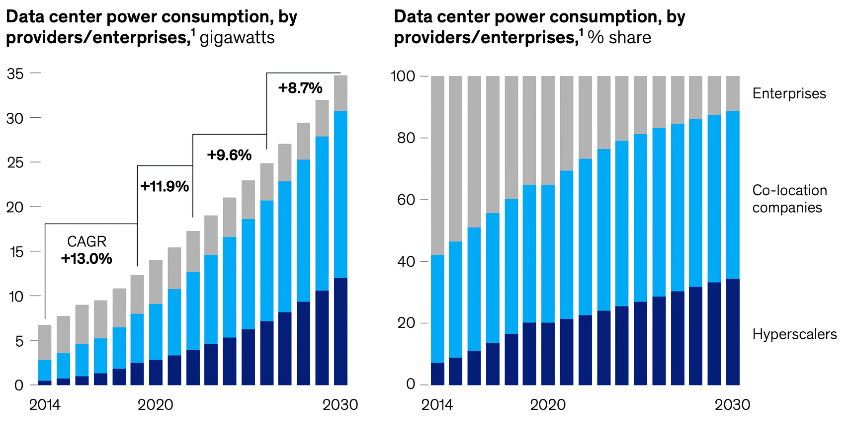

A major factor behind the skyrocketing demand is the rapid innovation in artificial intelligence, which is driving the construction of large warehouses of computing infrastructure that require exponentially more power than traditional data centers. AI is also part of a huge scale-up of cloud computing. Tech firms like Amazon, Apple, Google, Meta and Microsoft (AKA hypersclaers) are scouring the nation for sites for new data centers, and many lesser-known firms are also on the hunt.

Communities that had little connection to the computing industry now find themselves in the middle of a land rush, with data center developers flooding their markets with requests for grid hookups. Officials in Columbus, Ohio; Altoona, Iowa; and Fort Wayne, Ind. are being aggressively courted by data center developers. But power supply in some of these second-choice markets is already running low, pushing developers ever farther out, in some cases into cornfields.

The growing demand with the scarcity of available commercial space, with current and future power capacity, is driving ever larger and longer-term deals, like AWS’s acquisition of a PA facility.

According to the investor presentation, Talen sold the site and assets of Cumulus Data for $650 million. The 1,200-acre campus draws power from Talen Energy’s neighboring 2.5GW nuclear power station in Luzerne County, the Susquehanna Steam Electric Station (SSES). Talen said AWS aims to develop a 960MW data center campus. The cloud company has minimum contractual power commitments that ramp up in 120MW increments over several years; AWS has a one-time option to cap commitments at 480MW. The cloud provider also has two 10-year extension options, tied to nuclear license renewals.

Of course, banking’s role in energy-related financing is not without controversy or hazards. All politics are local.

West Virginia State Treasurer Riley Moore said he sent notices to six financial institutions last week, warning them their institutions appear to “be engaged in boycotts of fossil fuel companies,” according to West Virginia law.

The six banks who received notice Feb. 22 about potentially being added to the state’s restricted financial institution list include BMO Bank, Citibank, Fifth Third Bank, Northern Trust, TD Bank and HSBC.

2. Who gets to the steep part of the S-curve first?

Speaking of hyperscaling market players, NYU Professor Scott Galloway analyzes the acceleration of AI and why data may still be the ultimate trump card for capturing value in the future, even for companies that seemingly missed the boat.

This vast store of data is Alphabet’s deepest moat, and the company’s bridge to the future. This sort of data has become currency: Reddit, the Associated Press, Tumblr, WordPress — anyone with a full data center — have all monetized their (much smaller) pools of data for LLM training. Tesla will tell you that the biggest advantage it has in self-driving AI is the fleet — specifically, the years of real-world driving data that Teslas have sent back to HQ for processing by the company’s AI systems. But building better models isn’t how Alphabet can leapfrog OpenAI. It’s by customizing models that are purpose-built on its proprietary data sets.

Alphabet’s data flex is not that it knows more about the world, but about you.

This is a reminder that any company, especially banking and financial services, that has data and knows its customers better than anyone else sits on an extremely valuable asset.

If handled and deployed expertly, it’s an asset that may be more valuable than anything else on your balance sheet.

And that is it for this Friday. For your listening pleasure, the very classics of rock. Click below to let us know how we did: