This week, we look at the bold move by a short-selling hedge fund to trade on the news, by owning a media outlet. Also, we get a breakdown of the strategies and incentives behind reward cards for issuing institutions.

1. Short sellers go after mortgage giant

This week, the hedge fund Hunterbrook Capital launched a publishing arm. Of note is the $100M fund they’ve raised to trade on the information they uncover in their reporting directly. From Matt Levine’s Money Stuff:

Hunterbrook hit upon a differentiated media business model:

- They would start a newsroom (Hunterbrook Media) to publish general news and investigative journalism.

- There’s no paywall and no advertising.

- But before each investigative piece is published, the newsroom would send it to Hunterbrook’s affiliated hedge fund (Hunterbrook Capital), which could trade on the news.

- The hedge fund’s trading profits can — they hope! — pay the journalists’ salaries.

To launch this new venture, Hunterbrook published a scathing attack on mortgage giant UWM. The heart of their expose is the company’s move to corner referrals from mortgage brokers.

In 2021, UWM shook up the industry by changing its contracts with brokers to explicitly bar them from doing business with what were then two of its biggest competitors, Rocket and Fairway Independent Mortgage Corporation.

(CEO Mat) Ishbia called it the “All-In” initiative. In the industry, it became known as “the ultimatum.”

Since UWM forced brokers to make that Sophie’s choice, its share of the independent mortgage broker market has jumped to 48% from 31%, according to an Inside Mortgage Finance report and a UWM security filing.

During that same time period, the number of loan officers sending 99% or more of their mortgages to UWM has doubled, according to Hunterbrook’s data analysis.

The bulk of their analysis is focused on the impact of this move on the market and estimated “excess” borrowing costs for consumers. It’s their intent to profit from this insight that is drawing attention and calls about conflict of interest/ethics. Of note is the wild sidebar (for any other media property) at the top of the article, including:

Hunterbrook Capital took the following positions: The fund went short $UWMC, long $RKT, and purchased derivatives.

Additionally, they’ve engaged a law firm to initiate a class action lawsuit, filed a (potentially lucrative) SEC whistleblower report with the SEC, and shared their analysis with various state AGs, civic groups, and litigants of shareholders and brokers currently suing UWM.

2. Why all credit cards aren’t reward cards

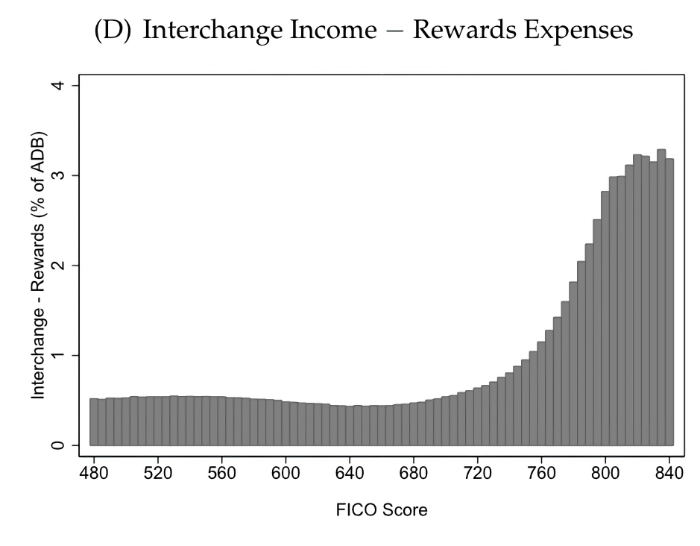

One of our favorites, Patrick McKenzie, wrote this week on the mechanics of credit card reward programs. The piece dissects the incentives and economics for issuers, particularly the skewed revenues for customers who aren’t even using revolving credit lines.

“The heaviest credit card spenders, and this fact is both uncontroversial and flies in the face of what many personal finance columnists believe, are wealthy and sophisticated. They use credit cards primarily as payment instruments. Issuers compete aggressively for their business, which is quite lucrative. This is not because they pay much in interest, because while they have higher headline APRs they only rarely revolve balances. It is because “clipping the ticket” via interchange on a high volume of transactions is an excellent business to be in.”

Also of interest is the analysis of JPMorgan Chase’s all-out assault on AMEX in 2016 with their Chase Sapphire Reserve offering and how they allied with Visa to pull it off.

SO ends this first Friday in April. It is a momentous moment in the decline of CDs (not that kind of CD). Click below to let us know how we did: