Every Friday, we share interesting things we’ve read or seen that may have slipped past or been misinterpreted by most of the news.

In the rapidly evolving world of finance, fintechs are not just disrupting traditional banking - they’re rewriting the rules of valuation. This week, we look at how fintechs manage to maintain tech-like valuations even after acquiring banking licenses, a move that would typically anchor them to more lower multiples.

1. Trading Like A Bank

Santiago Rodriguez and Alex Immerman of a16z, a venture capital firm with significant fintech investments, offer an explanation for how fintechs that acquire a banking license can avoid being valued like the banks they aim to disrupt.

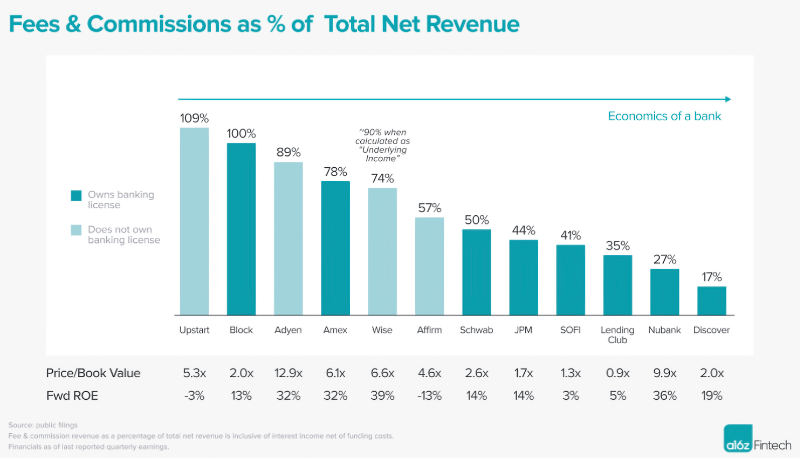

When a fintech gets a bank license, there isn’t a market switch that flips and suddenly starts valuing them as banks. Valuations are nuanced and depend on the nature of the fintech company’s business model. The more a company’s economic model looks like a traditional bank’s at maturity — meaning it generates the majority of its income via interest and requires equity investments to fund growth — the more likely it is to be valued as a bank (on the basis of its expected ROE).

But having a bank license does not mean a lower price-to-book multiple, as illustrated by a number of public companies today.

Through the investors’ lens, as fintechs encroach more and more into traditional banking business models, the market has not (yet?) normalized their valuations to traditional bank metrics. Looking at the historical numbers:

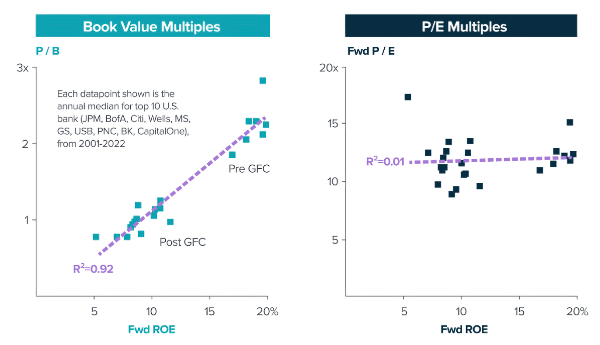

Large banks in the U.S. generate a ~8-12% ROE and trade for ~0.8-1.2x book value, meaning they are expected to return just about their cost of capital (~10%). Public valuation data demonstrate that the market makes assumptions about the ROE a bank will generate and uses shorthand P/B multiples to value it. Companies that are able to generate sustainably higher ROEs command higher valuations.

The key to understanding this lies in the Return on Equity (ROE) calculation:

Fintechs have two primary levers to pull for higher valuations:

- Higher Net Income Margins

- Digital distribution can slash costs by up to 85% (as demonstrated by Nubank)

- Tech-driven underwriting capabilities enable more accurate risk assessment

- Result: Higher margins through lower costs and better credit allocation

- Superior Asset Turnover

- Fintech business models often generate substantial fee-based revenue

- Fee revenue isn’t constrained by asset base size, unlike interest income

- Examples: Block (Cash App, Square, AfterPay), American Express, Adyen

Successful fintech disruptors will do so with a differentiated model that unlocks a long growth runway.

Differentiation may come from a number of sources, including:

- A unique product, like Greenlight’s financial toolkit for kids and teens or Monzo’s Personal Finance Management tools.

- Distinct distribution and network effects, like Revolut or Cash App’s peer-to-peer payment network.

- Product quality relative to incumbents, evidenced by Nubank’s NPS of ~2x other fintech companies and ~4x incumbent banks in Brazil.

The Takeaway

So far, fintechs are showing that it’s possible to have your cake and eat it too. By leveraging technology to reduce costs, diversify revenue streams, and offer unique value propositions, they can maintain the perceived advantages of tech startups while exploiting the benefits of a banking license. This approach allows them to continue to command premium valuations and attract capital to fuel growth.

While new investment into fintech as a sector has slowed to pre-2020 levels, follow-on funding continues to fuel the winners. In other words, the pressure from tech becoming more like banks has not fallen out of fashion. Neither have the economics for investors soured that will turn off the investment and funding. As a strategic imperative, you see the steady encroachment by fintech and neobanks as a permanent part of your competitive landscape. Having a plan for incorporating and co-opting technology as part of your business plan and culture is no longer optional.

And that it for this Friday. Keep your kids safe. Click below to let us know how we did: