For this last Friday in this leap year induced 29-day February, we have the CFPB’s study of credit card rates by institution size. Also, an economist’s look at the impact AI is starting to have on the tight (and growing tighter) labor market, think recruiting and training your next cohort of bankers.

1. For credit cards, small issuers offer lower rates

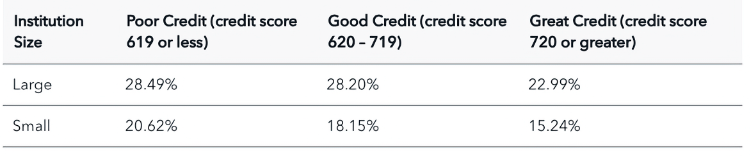

The CFPB issues a report showing small issuers’ median credit card APRs are significantly lower than the largest institutions’ rates, and impact on consumers from doing business with smaller financial institutions.

During the first half of 2023, small banks and credit unions tended to offer cheaper interest rates than the largest 25 credit card companies across all credit score tiers.

The difference in reported Purchase Annual Percentage Rate (APR) between the largest and small issuers translated to average savings of $400 to $500 a year for a consumer with an average balance of $5,000 using a small bank or credit union’s card.

Nearly half of the largest credit card issuers reported offering cards with a maximum purchase APR over 30%.

Products offered by large issuers were three times as likely to include an annual fee than those at small institutions. The average size of annual fees for the largest issuers was approximately 70% higher than at small institutions.

2. AI and the middle class

MIT economics professor David Autor has a new NBER working paper published in Noema titled Applying AI to Rebuild Middle Class Jobs.

The industrialized world is awash in jobs, and it’s going to stay that way. Four years after the Covid pandemic’s onset, the U.S. unemployment rate has fallen back to its pre-Covid nadir while total employment has risen to nearly three million above its pre-Covid peak. Due to plummeting birth rates and a cratering labor force, a comparable labor shortage is unfolding across the industrialized world (including in China).

This is not a prediction, it’s a demographic fact. All the people who will turn thirty in the year 2053 have already been born and we cannot make more of them. Barring a massive change in immigration policy, the U.S. and other rich countries will run out of workers before we run out of jobs.

Autor points to the difference in the nature of AI, and its ability to solve expertise

Like the Industrial and Computer revolutions before it, Artificial Intelligence marks an inflection point in the economic value of human expertise. To appreciate why, consider what distinguishes AI from the computing era that we’re now leaving behind. Pre-AI, computing’s core capability was its faultless and nearly costless execution of routine, procedural tasks. Its Achilles’ heel was its inability to master non-routine tasks requiring tacit knowledge. Artificial Intelligence’s capabilities are precisely the inverse.

In a case of cosmic irony, AI is not trustworthy with facts and numbers — it does not respect rules. AI is, however, remarkably effective at acquiring tacit knowledge. Rather than relying on hard-coded procedures, AI learns by example, gains mastery without explicit instruction and acquires capabilities that it was not explicitly engineered to possess.

A common issue for community banks and credit unions is recruiting and training talent. This is especially true for front-line tellers and support personnel. Gaps in experience are only solved with time in the job, today. What Autor points to is the ability to bring the collective experience and processes of your institution to every interaction. The virtual “expert” that whispers in the ear or displays the helpful prompt, “This is what you do in this situation…..”.

For business models built on a “people helping people” differentiator, capabilities like this may not just be a way, but the way to success and sustainable growth.

And that is it for this week. Anyone with teenagers will immediately recognize the technique that this panda uses for cleaning its house.

Click below to let us know how we did: