Every Friday, we pull together 2 or 3 items worth looking at that didn’t make the industry sites. These items fall within the scope of community banking (trends, markets, strategy), data (regulation, market sentiment, privacy), and the technology we focus on (AI/machine learning and data science).

This week, we examine the pitfalls of being a banking partner to fintech, banks’ AI readiness (read competitiveness), and a high-level snapshot of AI vs. human benchmark and where the trend is heading.

1. Common problems with banking partners

Fintech veteran Ayo Kunle updates his list of the more frequent issues with bank/fintech partnerships, in particular, the increase in regulatory scrutiny and action:

The thing I was most wrong about was this statement about Regulatory Problems:

“This is a low probability, high impact way things could go wrong”

If you’ve been following fintech over the last 18 months it’s clear that regulatory problems are much higher probability as a meaningful number of the banks that underwrite fintech programs in the United States have since been hit with a number of consent orders

Ayo breaks down the specific aspects of a banking partner where problems arise.

(Banking partners) are the repository for several crucial relationships that rarely matter until they really matter, and when they really matter, they are all that matters. These roles include

- The regulatory interface: most banks you’ll interact with will be regulated by the FDIC. Whenever something happens and the FDIC needs to talk to someone, they’ll most likely talk to the bank and not you.

- The regulated entity: most banks you’ll work with will be Durbin exempt and as a result be able to rely on relatively high interchange for consumer debit (if your business is consumer focused and dependent on card interchange as revenue, this will be key).

- The compliance entity: the bank’s charter is on the hook if a card issuer breaks the rules (like not resolving disputes on time, money laundering, or holding people’s money) so most banks will maintain some control over how card programs comply with the various rules.

- The network interface: the bank is typically the entity with a contractual relationship with a network like Visa, Mastercard or others.

…and specific examples in each area:

Several types of interchange hacks exist, for instance,

decoupled debit; using a balance in bank 1, typically durbin regulated, to fund card transactions in bank 2, typically unregulated (thus earning higher interchange on transactions than bank 1 is eligible for)

authorized user; issuing cards on a commercial debit bin for a use case that is truly consumer focused

Well worth looking at to consider your own partnership and/or for evaluating any future expansion.

2. Who’s best-positioned for the AI boom?

CBInsights presents their Retail Bank AI Readiness Index, looking at the talent/hiring, products in market, and vision/strategy specifically in AI.

Most top banks are lagging behind in AI innovation. Only 6 of the top 50 have made an AI acquisition. Fewer than 20 have participated in 3 or more deals to AI startups.

- Among the 50 largest banks, Citi is the top investor in AI startups, backing nearly 30 deals since 2019 (including deals from its venture arm). It recently invested in a follow-on Series C round to AI-powered data governance startup Securiti.

- Notably, ING’s incubator ING Labs spun out Weaviate, a developer of vector database technologies, in 2019 — years before the vector database market would take off amid the generative AI boom. ING Ventures has since backed the company across 2 funding rounds.

Leaders in applying for AI-related patents include JPMorgan Chase, Capital One, and Bank of America.

3. Stanford AI Index 2024

Stanford University’s Institute for Human-Centered Artificial Intelligence this week released their 7th annual Artificial Intelligence Index. Written from the heart of Silicon Valley and from the institution that births much of the innovation/startups in the space, the 500-page report aims to provide a broad look at the state of capabilities and give a point-in-time snapshot of where the technology is. Highlights from the executive summary:

AI has surpassed human performance on several benchmarks, including some in image classification, visual reasoning, and English understanding. Yet it trails behind on more complex tasks like competition-level mathematics, visual commonsense reasoning and planning.

According to AI Index estimates, the training costs of state-of-the-art AI models have reached unprecedented levels. For example, OpenAI’s GPT-4 used an estimated $78 million worth of compute to train, while Google’s Gemini Ultra cost $191 million for compute.

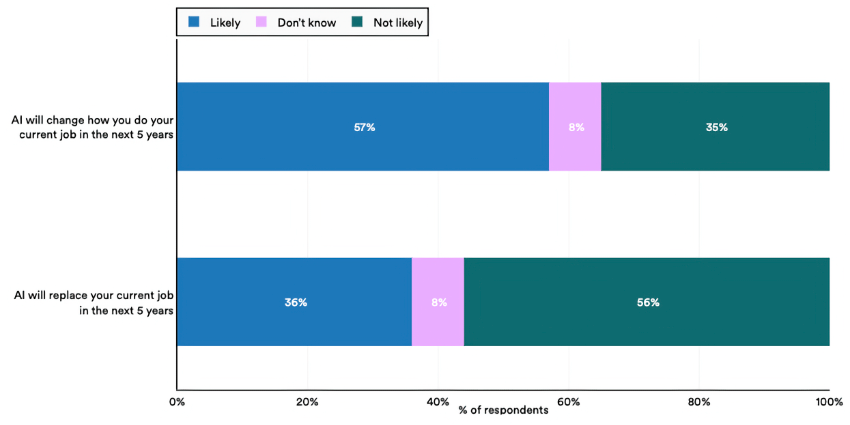

In 2023, several studies assessed AI’s impact on labor, suggesting that AI enables workers to complete tasks more quickly and to improve the quality of their output. These studies also demonstrated AI’s potential to bridge the skill gap between low- and high-skilled workers. Still other studies caution that using AI without proper oversight can lead to diminished performance.

A survey from Ipsos shows that, over the last year, the proportion of those who think AI will dramatically affect their lives in the next three to five years has increased from 60% to 66%. Moreover, 52% express nervousness toward AI products and services, marking a 13 percentage point rise from 2022. In America, Pew data suggests that 52% of Americans report feeling more concerned than excited about AI, rising from 38% in 2022.

That’s it for today. Sometimes KYC involves checking for a pulse. Click below to let us know how we did: