The nine most terrifying words in the English language: I’m from the government, and I’m here to help.” It’s one of the best-known lines from Reagan. After nearly 40 years, many think it still sums up what happens when government actions meant to solve one problem can lead to another. Enter the Durbin Amendment.

Ayo Omojola provides a unique perspective from inside Fintech Block, then Square, during their time of exponential growth. Ayo’s story recounts how the Durbin amendment to 2010’s Dodd-Frank act paved the way for the growth in payment Fintechs. In particular, he lays out how selective regulation strengthened the hand of Fintech entrants and pushed regulated FI’s into more reliance on fee-based revenues.

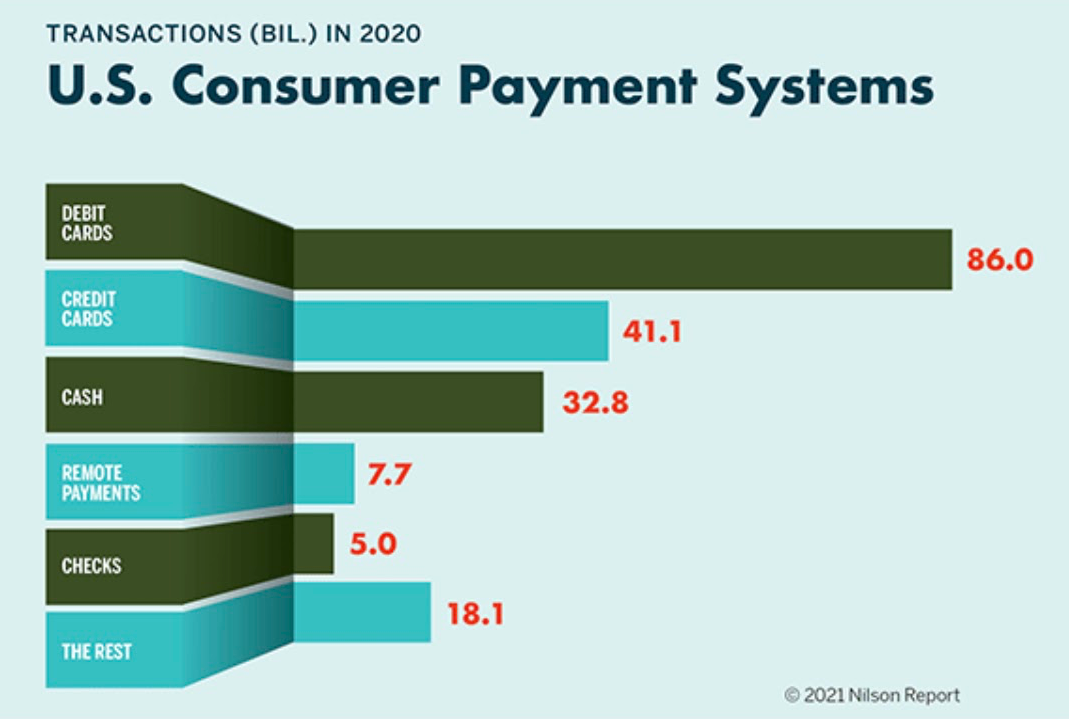

Square, Stripe and PayPal were early, large beneficiaries of the Durbin Amendment, for two reasons. First, they charged merchants stable take rates that abstracted away the complexity of interchange (as opposed to industry standard cost-plus). Second, they (naturally) processed a mix of debit and credit card payments, and 80% of debit card payments are on cards issued by Durbin regulated banks, and debit is a meaningful portion of the mix of card payments (for offline payments, debit is close to 60% of the mix both by volume and count.). Overall, debit is the single largest consumer payment method in the US.

While the regulation specifically excluded community FI below $10B in assets, it also put wind in the sales of the customer acquisition machines of peer-to-peer (P2P) payment apps.

Companies like Cash App, Venmo and PayPal relied on low Durbin regulated rates to fund card loads in the early days, prior to the Visa AFT (Account Funding Transaction) and the MasterCard MoneySend transaction becoming widely available. Durbin regulated rates provided a way for customers of P2P platforms to fund their digital wallets at much lower cost per transaction (to the platform) than Durbin exempt interchange, by linking a debit card. Debit still cost more than ACH, but debit pulls are simultaneously faster and more reliable. These products enabled customers to add funds to their digital wallets by linking a debit card. The platforms paid the (now lower) interchange fees on the 80% of debit card volume that were Durbin regulated.

The result was explosive growth in their adoption. Below is a chart showing the number of accounts accumulated over 30 years and five M&A deals by J.P. Morgan Chase since 1990. Plotted against that are the estimated customer account growth for Venmo (acquired by PayPal) and Cash App, Block’s P2P application.

And more pressure is coming

In July of 2022, Senator Durbin (D-IL) again proposed regulation, this time targeting credit card networks. The proposed legislation, while aimed at the dominant position of Visa and Mastercard, could be another opening for fintechs.

On July 28th Richard Durbin, the same Democratic senator who regulated debit interchange a decade ago, introduced the Credit Card Competition Act (ccc). It does not propose a cap on interchange, as the debit rule does, since costs for credit cards are more variable than for debit cards, making it harder to find the right level.

Instead, the ccc would attempt to spur competition by breaking the links between card networks and banks. At present, when a bank issues a credit card every transaction on it is processed by the card network the bank stipulates, meaning the bank is guaranteed the interchange fee the network sets. If the ccc becomes law it will force banks to offer merchants the choice of at least two different card networks. Crucially, these choices could not be the two biggest—at least one smaller network would have to be offered. They could compete for business by offering lower interchange rates, and merchants would presumably jump at the offer.

In addition to the competitive and regulatory pressure on NSF, interchange fees from credit card issuance could end up eroding non-interest income for community FIs. Today the alternative credit networks are primarily covered by Discover and AMEX, but if merchants have the opportunity to pick and choose, this could be another payment opportunity for fintech.

What to do about it

Community FIs provide an essential service to the country, especially to people at most risk of being left out of full economic citizenship. Access to banking is necessary to fully participate in society, full stop. The environment, including regulation, has shift the trend away from de novo bank creation and to mergers and industry consolidation. This weakens access and creates cracks for many people to fall through.

By all means, participate in your state and national associations. Leverage your collective voice with government lawmakers and regulators to keep this critical industry alive. However, holding out hope that there is a legislative solution to the threat to your bank or credit union is just that. Hope. And hope is not a sustainable long-term strategy.

Your privileged position of trust is a distinct advantage vs. fintech. Taking a deliberate path to make that historical branch experience to all of your touchpoints is vital. In times of flux and uncertainty, companies that leverage their proximity to customers, combined with a pragmatic approach to shifting focus, substantially raise the odds of success.

Understand that your business model is under attack. You cannot be passive. You must actively prepare for more new and stronger competition in point financial products and solutions. If you’re looking for ideas or places to start, reach out, and we can point to plenty of examples of organizations like yours that are well on their way to ensuring the long-term sustainability of their FI.