Hearing What Your Customers Are Telling You Through Their Behaviour

An academic paper in the International Journal of Information Management A big data analytics model for customer churn prediction in the retiree segment (Volume 48, October 2019, by Farid Shirazia and Mahbobeh Mohammadi) looks at the insights that first -party data can provide financial institutions. In this example, researchers from Ryerson University, Toronto, Canada, conducted a study of the behavior of retirees and their likely hood to churn from their primary institution around the life event of retirement. They looked at several data sources, including banking balances/transactions, communication with clients, online shopping through the bank’s partner referral portal, and changes in demographic data like job status, address, and marital status.

From their analysis, the researchers were able to identify a more granular segmentation of targeted clients and several prescriptive trigger points where the bank could make significant changes in its retention rate.

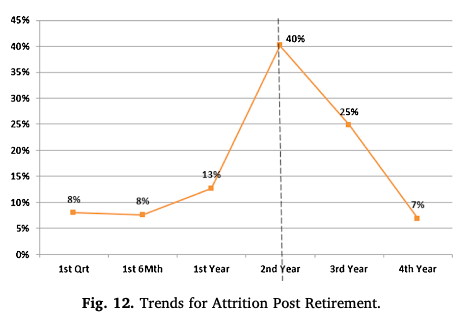

Based on the conducted analysis, this research supports the first hypothesis that the churn rate has a significant correlation with events of retirement. As discussed, the attrition rate significantly decreases after a retirement event occurs; however, as illustrated in Fig. 12, the churn rate spikes between year 2 and 3 after retirement amongst those who retired and then attired. It can be explained based on the fact that

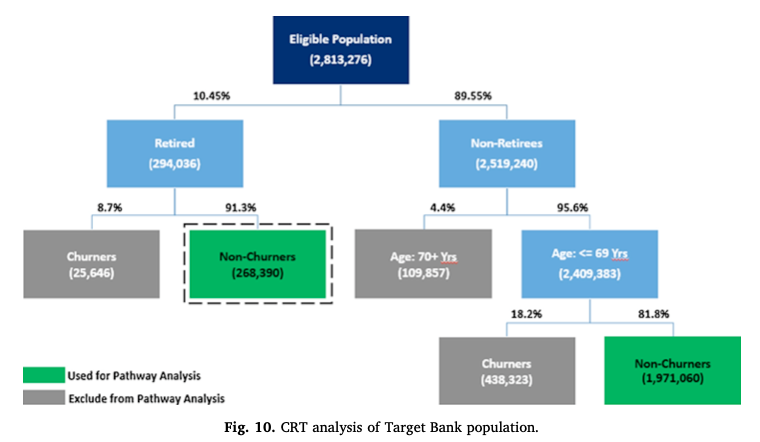

They also created a much more detailed and defined segment of their target audience to determine their opportunity and specific audience to focus retention efforts on.

Consequently, prediction analysis was applied on the remaining 95.6%. The result of this analysis confirmed that 18.2% of these clients are potential churners, while the remaining 81.8% are retained and loyal clients who will retire and remain with the target bank.

While much of the academic paper goes into the technical aspects of the researchers’ approach, the net is the insight the bank could draw from their analysis. They uncovered a very specific and repeatable definition of customer that was at risk of churning, right before their most profitable period as a customer. Using the data the bank already has, they can proactively engage with existing customers and drive up their profitability significantly.

What actionable information are you missing? Are there areas where you’re just guessing about what your customers’ behavior is telling you? We’d love to talk about it and help fill in the blanks.