Every Friday, we share items we’ve read that seem to have missed attention but inform and impact community financial institutions. This week, the largest bank in the country commits to building 100 new branches, maybe next to yours.

1. The community banking plans of a decidedly not community bank

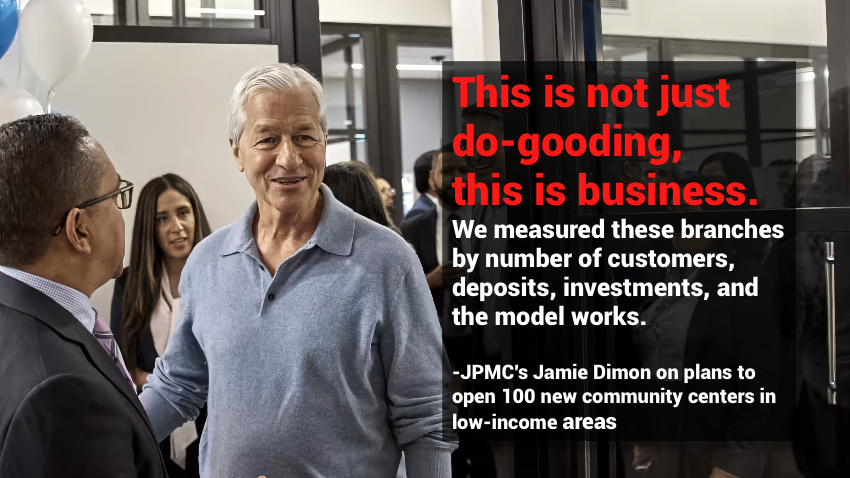

JPMC announced this week plans to open 100 new “community centers” in inner city and rural areas designated as low-income.

The model for this expansion started with their first community center, which opened in Harlem in 2019. The approach and design of the community center experience are anchored in community engagement and financial education.

The bank is also hiring 75 new community managers to work at some of these branches. Hired locally, the managers aren’t supposed to sell or market Chase products. Instead, they are meant to partner with community organizations and help teach residents on best practices to grow their wealth—and build trust in the Chase brand at the same time.

This effort plays into JPMC’s overall strategy for branch expansion, which started in 2018. Since then, the bank has opened over 650 new branches and became the first bank with a branch footprint in all lower 48 states. This presence was only bolstered by their acquisition of the failed First Republic last year. To put that in perspective, only 17 banks today have more than 500. JPMC is approaching 5,000.

Like the quote above, Dimon continues to put on a pragmatic public face about their investment and insist they absolutely intend to do well by doing good.

“We did not know if they were going to work,” he said. “If they didn’t work, we wouldn’t do them.”

And that’s reflected in the way they discuss the results of the experiment.

Data from Chase’s first community center branch in New York’s Harlem show that customers opened more checking accounts there versus any other branch in the neighborhood between 2019 and 2023. Four years after the expanded branch opened in 2019, personal savings balances there had grown 73%, according to JPMorgan.

Whether you think this is cynically a loss-leading branding effort by the #1 bank in the country or a serious effort to close its last few gaps in addressable opportunity, it would be malpractice not to have a credible plan to position and message against a community center opening in your community.

A good place to start is by seriously answering questions like:

- Who are we for? Specifically, who exactly are our customers, and is that definition sharper and more relevant to them than JPMC’s story?

- In what tangible ways do we demonstrate and communicate trust? Our time in the market? What customer stories and other social proof can both show our long-term commitment to the community and continued relevance to today’s needs?

- If you found the above answers unsatisfying or difficult to answer, take a step back and think about what it is you do for your customers and members every day. Look beyond just the convenience of having a physical location near work or home, dig into the details of the many ways in which you add value and help them solve, often tremendously important, problems, and then work back from there.

That’s a wrap for this week. May God grant you one day this man’s confidence. Click below to let us know how we did: