This week we look at the CFPB final rules for credit card fees, the resurgence of interest in true “local” banking, and how technology and technical talent can increase that momentum.

1. CFPB Final Rule on Card Fees

The CFPB this week issued an update to Reg Z this week adding new limits to credit card penalty fees. Highlights of the final rules:

- Lowers the immunity provision dollar amount for late fees to $8: Based on data analyzed by the CFPB, a late fee of $8 would be sufficient for larger card issuers, on average, to cover collection costs incurred as a result of late payments.

- Ends abuse of the automatic annual inflation adjustment: The CFPB found that many issuers hiked their late fees in lockstep each year without evidence of increased costs. The CFPB’s final rule eliminates the automatic annual inflation adjustment for the $8 late fee threshold. This adjustment was added by the Federal Reserve Board and is not required by law. The CFPB will instead monitor market conditions and adjust the $8 late fee immunity threshold as necessary.

- Requires credit card issuers to show their math: Larger card issuers will be able to charge fees above the threshold so long as they can prove the higher fee is necessary to cover their actual collection costs.

Of note, this summary chart of changes clarifies the exception for smaller issuers.

A card issuer is a smaller card issuer for purposes of this section if the card issuer together with its affiliates had fewer than one million open credit card accounts for the entire preceding calendar year. For purposes of this definition, affiliate means any company that controls, is controlled by, or is under common control with another company, as set forth in the Bank Holding Company Act of 1956.

2. Switching to hometown banks

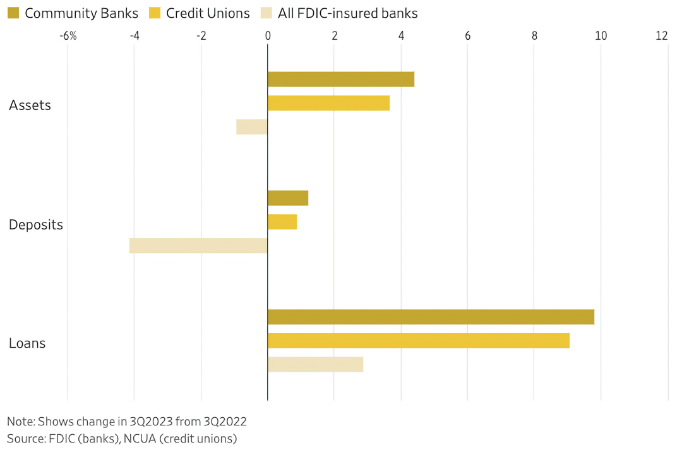

Imani Moise of the WSJ writes on the resilient growth of community banks and credit unions despite larger banks getting larger in a trend of consolidation.

Some bank customers are going small, pushing back against a wave of consolidation that has concentrated deposits and loans in a handful of the largest banks. Many have found that making a switch not only gets them more face time with bankers, but they are also earning more and paying less.

The piece covers many of the trends driving the behavior, but in particular anecdotes of customer experience with large banks.

Laurie Matta, the chief financial officer for the city of Clarksville, Tenn., decided to move the city’s bank accounts from the U.S.’s fifth largest lender, U.S. Bank, after a mix-up during the pandemic. The bank accidentally credited the city for a remote deposit twice, leaving an extra $150,000 in the account. It took six months, and many unsuccessful attempts to get the bank to correct the error, even though it shared an office building with city hall.

3. Regulation, talent, fintech, and growth in banking

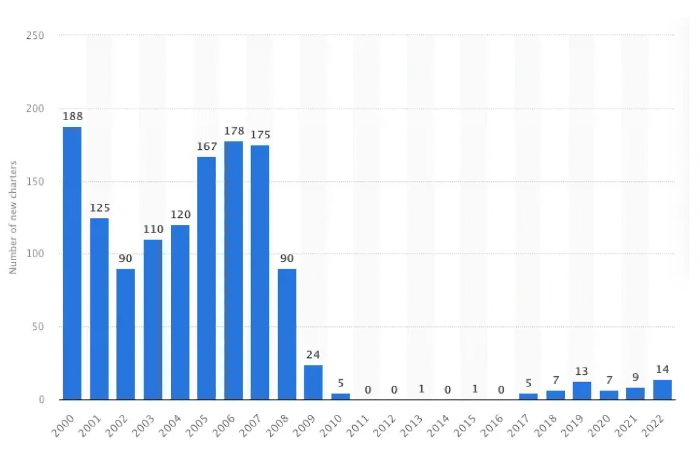

In a similar vein to the perils of banking consolidations, Ayo Kunle writes on the three main elements that can prevent further consolidation of banking market in the US.

I contend that two of three things must happen for the American banking system to have a shot at not becoming Canada/Brazil/Australia (with no offense to any of those countries). Either

1. The regulatory framework for de-novo banking must become far more straightforward and predictable (resulting in higher return on capital opportunity for investors, or lower startup costs). This can drive more investor demand for the creation of new banks.

2. The breadth of talent, practices, infrastructure and tools that have blossomed in fintech over the last decade must begin to migrate into the traditional financial system. This can be driven by traditional banks adopting the new technology, or new banks being built around them

3. The underlying infrastructure on which our banking system runs must modernize; tools for real time money movement, real time exception detection, continuous compliance & reporting, synchronous front office and back office communication, and rules updated for modern life.

That’s a wrap for this week. The new emerging risk to banks? Super Bowl winning pseudo-mascots. Click below to let us know how we did: