This week, we look at the consumer behavior of Gen Z and the opening for community financial institutions. Also, a deeper dive into the Federal Reserve’s playbook if the US ever crashes into the debt ceiling.

1. Credit and debit take share

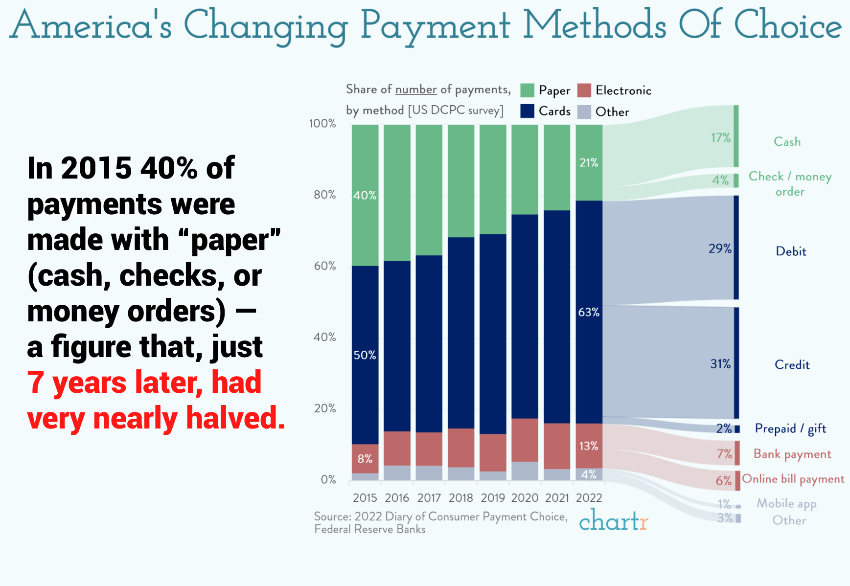

Data visualization studio Chartr looked at trends from the annual payment study from the Federal Reserve. Notable is the increasing use from a transaction volume of credit and debit (above).

From a dollar-weighted standpoint, traditional banking still drives most movements.

On a $-value basis, bank and online payments account for the most actual money changing hands, with some 43% of total dollars spent with the 2 electronic methods in 2022, while cash’s share sinks even further to just 5%.

However, retailers are increasingly incentivizing cash payments with discounts to avoid interchange fees.

Last year, some 2.93% of all cash payments came with a discount, as merchants still look to avoid excessive “swipe fees”. Those fees, set by payment networks to charge customers every time they use one of their credit cards, can regularly cost between 2-4% of the transaction — a surcharge that reportedly sets the average US family back more than $1,000 each year (according to the National Retail Federation).

One key demo that has jumped on the cash train? Gen Z.

Gen Z seemingly can’t get their hands on enough of the stuff, with 23% adopting it for the majority of purchases and 69% using it more than they did last year.

2. The new grad is your best friend

And speaking of the hotly contested customers of tomorrow, Morning Consult presents Why Gen Z Is the Most Likely Generation to Open New Bank Accounts (paywall). Based on their consumer survey results, Morning Consult looked at the differences in US banking behavior between generations.

72% of Gen Z adults have a checking account, and 57% have a savings account. But it’s likely that many of these accounts were created by, and even remain partly or fully managed by, older adults in their lives.

Of note is the spike in this activity comes after graduation and starting the first job.

As this generation enters college or the workforce, they’re establishing financial independence and, in turn, seeking out new accounts of their own. Around one-sixth of Gen Z adults opened a new account with a bank or credit union in August. And they’re around 10 percentage points more interested than adults overall in opening new “entry-tier” accounts — those with banks, credit unions or credit cards — in the next six months.

There’s a lot to unpack in understanding trends from research, but using it to drive and improve your performance is valuable. Do you run a new graduate campaign to acquire new depositors? Do you double down on it in the Summer months? Does your new account growth reflect this trend?

3. The Fed and the debt ceiling

Nathan Tankus of Notes on the Crises writes an analysis of the 2011 “Treasury Default” Playbook on what the Federal Reserve would do in the case of a debt limit default of the Treasury.

Based on a Freedom of Information Act request of a 2011 FOMC memo (now public), Nathan looks at the steps the Fed would take to use “accounting gimmicks” to permanently and unilaterally avoid default.

There are all sorts of day to day things that the Federal Reserve does that provide liquidity to treasury markets which the Federal Reserve would continue (in a crisis). But what are those options?

- Outright purchases of Treasury securities

- Rollovers of maturing Treasury securities.

- Securities lending activity.

- Repurchase agreements.

- Discount window lending.

These tools are very familiar to people who read about monetary policy. The main surprise here is regarding the first “option”. In inferring the contents of this memo from the FOMC transcript, I didn’t realize that the first option included the purchase of defaulted treasury securities. Yet, it does.

It’s a deeper read, but worth seeing that the Fed has both a capability and plan to provide liquidity to the Treasury market, even in the case of a debt ceiling crisis. Boring details? Maybe, but it casts the hyperbolic arguments of congressional standoffs to the debt ceiling in a different light and may raise unease about the level of autonomy of the Fed.

And that’s it for this Friday. And for the Lord of the Rings fans, test your knowledge with “Is this an Antidepressants or Tolkien character?”. Click below to let us know how we did: