For this week, we look at a hot take on the Capital One offer for Discover Financial Services and the behind-the-scenes disruption of financial systems around holidays.

1. The third network

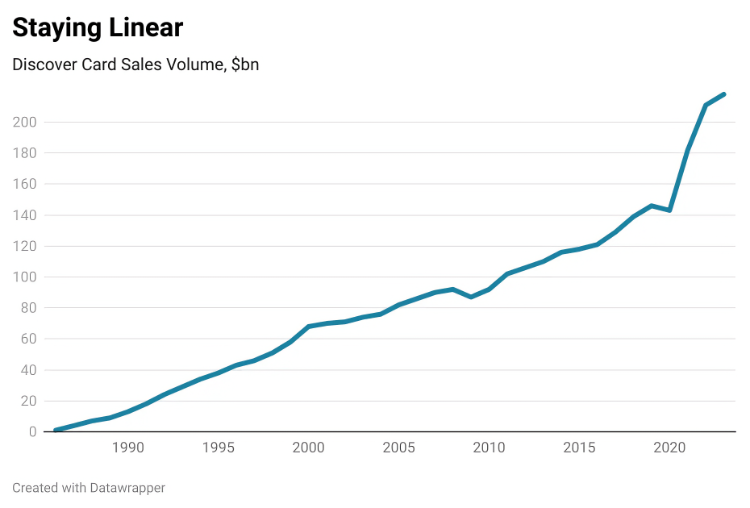

In what will certainly get a lot of regulatory scrutiny, Capital One has a $35B offer on the table for rival credit card Discover. a16z’s Marc Andrusko speculates at why Discover may command a 28% premium.

- Scale — the merger would create a pro forma $250 billion credit card loan book, which would be the largest in the country, surpassing J.P. Morgan’s $211 billion.

- Regulatory arbitrage — Discover is carved out from the Durbin Amendment, which would mean a higher rate of debit interchange revenue for the combined entity.

- The creation of a large closed-loop network — the combined entity would operate as both the issuer and network at scale, which creates opportunities to provide merchants with more granular data and unique value-added services.

That last point is the most significant. Marc Rubinstein has a break down the history of card networks and why the network is the crown jewel in the deal.

2. Financial systems take a holiday

In another banger post, Patrick McKenzie breaks down the implications, operational issues, and anti-fraud aspects of banking holidays.

Take Black Friday / Cyber Monday.

Anyhow, once a year, extremely predictable in timing but not necessarily in magnitude ($18.6B on Stripe alone over the long weekend in 2023), you do not need to float one day of sales, like you do daily. You do not need to float three days, like most weekends. You need to float five-ish days including the largest sale day of the year. And you whisper fervent prayers that all the wires you expect arrive exactly when you expect them.

…and I concur with his assessment of Jeremy Irons’ performance in Margin Call.

That’s for this week, and now it’s March. I’m sure all of you struggling to recruit talent can identify with this struggle, “Recently, I was asked to fill a role for a chef, literally just for Dobermans.”

Click below to let us know how we did: