Every week, we share a few stories on the world of banking, data, and tech that caught our attention and didn’t make the headlines.

This week, we look at weakness in the CRE bond market and trends in consumer spending and sentiment from the 1st half.

1. Real estate meltdown strains even the safest office bonds

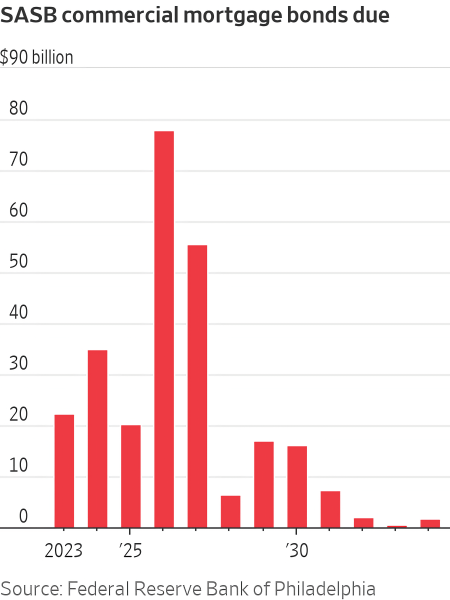

Matt Wirz in the WSJ writes on the impact rates and CRE valuation are having on the bond market, particularly those backing office and mall projects that are coming due in the next 2 years.

There are about $260 billion of the deals, known as single-asset, single-borrower bonds, held by investors such as banks, insurers, pensions and mutual funds. Landlords, often private-equity firms, used that money to purchase skyscrapers, shopping centers and other properties.

Much of the debt is coming due and refinancing markets are frozen for many office and retail landlords. Some are defaulting even before their due dates because their interest expenses soared when the Federal Reserve raised rates.

These so-called SASB bonds were meant to be ultrasafe, but the rate of loans at or near default has nearly tripled over two years, hitting 8.7% in 2024, according to data from the CRE Finance Council, a trade group.

SASB bonds backed by malls and offices are already in default in Chicago, Los Angeles, New York, Philadelphia and San Francisco. Some properties are still hanging on but struggling to attract tenants, pushing prices of their lower-rated bonds below 20 cents on the dollar.

Which of course, has opened the door to secondary distressed assets buyers:

Meanwhile, falling SASB prices are attracting bargain-hunting fund managers including Beach Point Capital Management, Ellington Management Group, TCW Group, TPG Angelo Gordon and Waterfall Asset Management.

One strategy is to buy bonds betting that the properties will be sold off for higher-than-expected prices. Another is to find buildings that will return to profitability or manage to keep paying interest for years before defaulting. Some investors are buying bonds of properties that are still profitable, but trade at low prices because of the stigma around commercial real estate.

For a more in-depth discussion of secondary CRE debt buying, see our discussion with Greg Freedman of BH3 Management and his analysis of the market and how it differs from 2008/2009.

2. Consumers are still spending

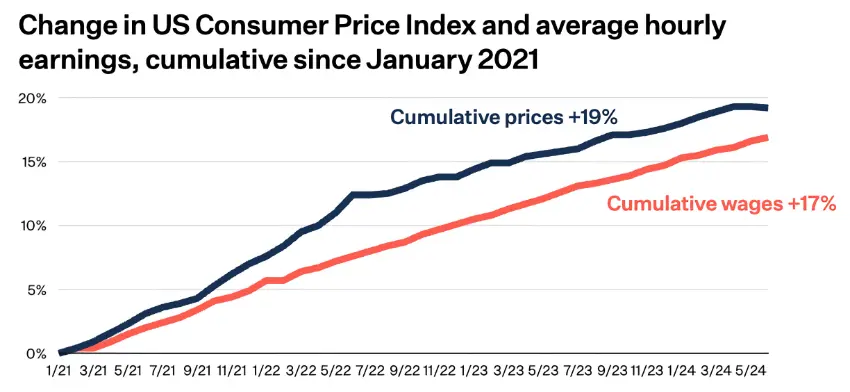

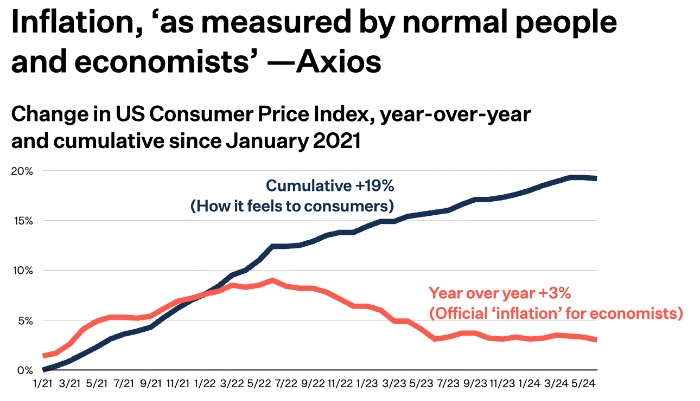

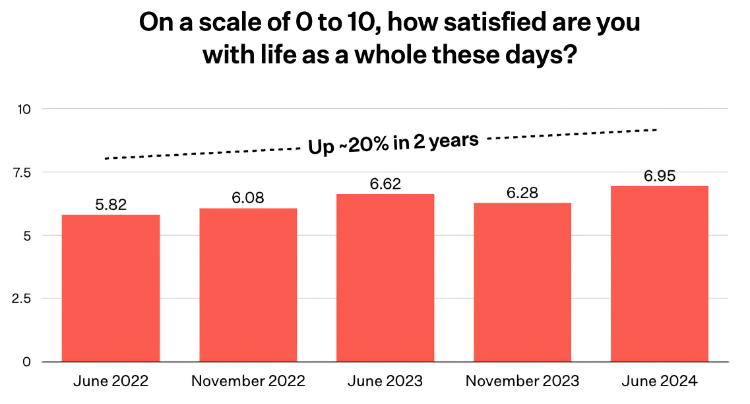

Dan Frommer released his New Consumer 2024 Mid-Year Report this week with a surprisingly upbeat consumer sentiment despite inflation pressures. A few select slides from the report:

“The meaning of the word ‘inflation’ has changed. It used to mean rising prices; now it means high prices.”— Felix Salmon, Axios

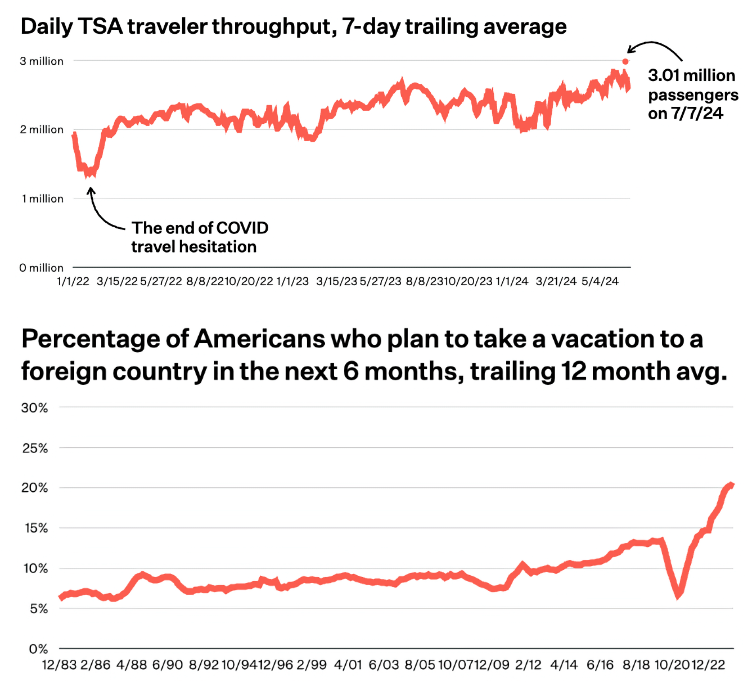

This has not dented many categories, such as dining out, beauty, and in particular, travel:

The report includes more trends, including Gen Z’s affinity for brands, the non-obvious spending impact from Americans taking GLP-1 weight loss treatments, and YouTube’s reach and impact by generations.

And that’s it for this Friday. Even on your very worst day at work, you’re unlikely to cause $2.3M in damage this fast?. Click below to let us know how we did: