To end this first week in October, here are two stories on topics many of you have shown interest in and provided feedback on. First, the CFPB gets its day in court, and looks to prevail. Also, the bonanza of rising rates for private equity may be coming to an end.

1. CFPB at the Supremes

While the trial of Sam Bankman-Fried of FTX infamy led many headlines this week, another hearing may be of more interest to community bankers.

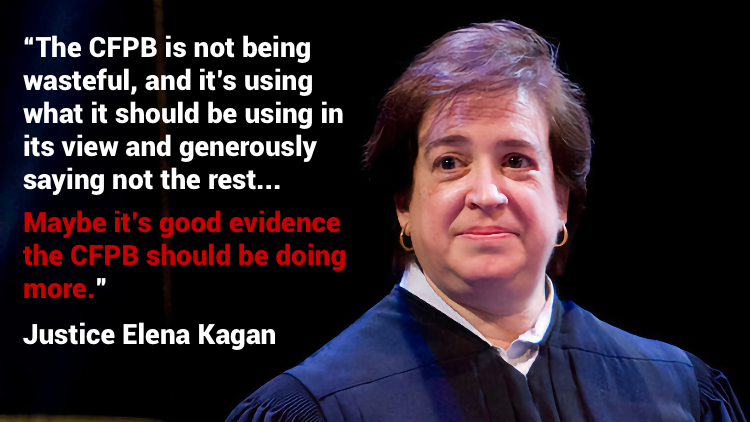

Vox’s Iaa Millhiser writes on the SCOTUS hearing of Consumer Financial Protection Bureau v. Community Financial Services Association. Reading the tea leaves of the day’s arguments would indicate the agency isn’t going anywhere anytime soon.

Imagine that the Supreme Court of the United States spent an entire morning debating whether penguins are the primary cause of colon cancer or whether John F. Kennedy was assassinated by aliens from the planet Venus.

That’s more or less the quality of arguments that former Trump Solicitor General Noel Francisco presented to the Court on Tuesday, as part of a quizzical effort to convince the justices to declare an entire federal agency unconstitutional.

Beyond the pointed editorial of arguments above, Emily Mason of Forbes takes a more measured view of the facts before the court.

This case arises after a fifth circuit court of appeals ruled that the CFPB’s funding structure is unconstitutional following a challenge to the bureau’s payday lending rule. This is the latest in a string of challenges to the CFPB’s existence. In 2020, the Supreme Court ruled that a limitation on the president’s ability to remove the single director of the CFPB violated the separation of powers design of the U.S. Constitution. Both the insulation from the annual appropriations process and limitation stating that the director of the bureau could only be removed by the president “for cause” were designed to protect the agency from political pressure.

Dodd-Frank gave the CFPB the authority to create regulations for financial institutions to comply with legislation like the Truth in Lending Act, a 1968 law designed to ensure fair consumer credit products. The post-2008 reforms of TILA largely hinge on the authority of the CFPB. These amendments included defining a new category of more expensive mortgage loans, including most subprime loans secured by the borrower’s primary residence. The CFPB enacted new appraisal requirements for higher-priced mortgages, expanded requirements for mortgage loan servicers and new origination rules. If the agency’s funding structure is deemed unconstitutional by the Supreme Court, it could call into question all of the rules the CFPB has created.

It seems few of the bench were convinced by the challenge to the agency’s legitimacy.

By the time the argument was over, only Justice Samuel Alito appeared to be a certain vote for Francisco’s poorly articulated position. And Alito, who is typically the most reliable Republican partisan on the Supreme Court, was reduced to incoherence himself — complaining at the end of the oral argument that he is concerned the Court’s decision in Cincinnati Soap does not impose a sufficiently aggressive “limiting principle” on Congress.

2. Private credit profits under scrutiny

Last week, we looked at the growth of PE in private credit. This week, Bloomberg writes on the growing pushback from investors of private credit funds fees.

Investors are asking whether it’s fair for direct-lending funds to make excess returns just because a central bank hikes interest rates.

Private credit firms usually have a hurdle rate of between 5% and 7%. When a fund’s returns hit that threshold, it can start sharing in the profit, on top of the 1%-2% management fees collected through a fund’s life. Managers often get about 10%-15% of the returns once they’ve passed the hurdle — a significant dent for investors who get all the profit before that happens.

This is resulting in a reshuffling of terms and tying funds fees to generating returns vs. just being a boat lifted by the tide.

With investors demanding flexibility, one popular option is pegging hurdles to central bank rates, meaning they rise or fall according to monetary policy. “There’s a general sense that investors are not pleased with fund managers who insist on maintaining the status quo,” says Kirsten Bode, its cohead of pan-European private debt.

And that’s it for this week. Some people are living in the future. Give us a click below to let us know how we did: