For this week, we look at where banks are investing and expecting results from AI, and bank mergers get more scrutiny,

1. The AI agenda at big banks

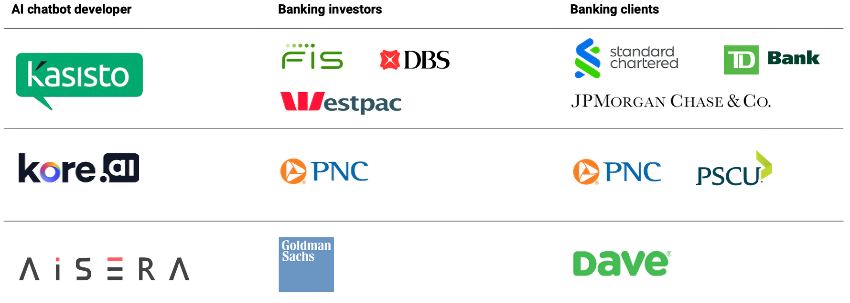

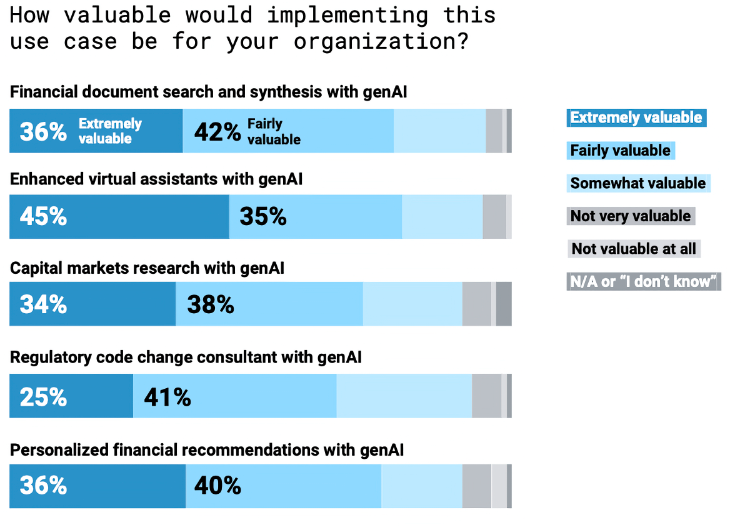

Throughout earnings calls at big banks year to date, talk of AI jumped to an all-time high in both the number of institutions and frequency of mentions. Research firm CBInsights captures the sentiment of bankers’ bullish investments and partnerships in their Tech Trends 2024 report.

“Consumers interacted over 20 million times last year with Fargo, our AI-powered virtual assistant.” Wells Fargo CEO Charles Scharf, Q1’24 earnings call

“…to the extent that we can deploy [AI] wisely, … we can always hire a little less if we see the efficiencies coming through and redeploy the people we have.” Bank of America CEO Brian Moynihan, Q1’24 earnings call

Much of the focus is on operational efficiency and reducing costs.

2. The OCC shines more light on banking mergers

Pete Schroder at Reuters reports on the Office of the Comptroller of the Currency (OCC) proposal for increased transparency regulations for bank mergers and acquisitions.

The move by the agency comes amid industry criticism that regulators are too opaque in their handling of bank deals, and as analysts expect more consolidation among small lenders struggling with flagging margins.

Acting Comptroller Michael Hsu laid out issues with both “good deals” that are being slowed by regulations and “bad deals” that aren’t getting a close enough look. This effort comes at a time when the agency has taken criticism for last year’s rescue of First Republic by JPMC.

Some mergers are problematic because the banks involved have supervisory issues, whereas banks that have a high supervisory rating with no lingering enforcement concerns are more likely to get the green light for a merger or acquisition, Hsu said.

At the same time, the agency proposed scrapping a 1996 policy under which some deals are automatically approved if the OCC does not act on the application within a certain timeframe.

“You have two risks with mergers: One risk is that we approve too many mergers and therefore we’re approving bad mergers. The other risk is we approve too few mergers and therefore there are good mergers that should happen that aren’t,” he said. “The purpose of being transparent is to encourage more accuracy on both ends.”

And that is it for this Friday. I think we all have a story of problematic family issues that takes a funny turn, but probably not this funny.

How’d we do this week? Let us know: