Each week, we look at a couple of stories at the intersection of banking, data, and technology that may have been overlooked or offer a unique and contrarian perspective on the world.

This week, BNPL gets the side-eye from economists and the CFPB, as well as the mixed results community FIs are seeing from their digital transformation dollars.

1. BNPL gets more scrutiny

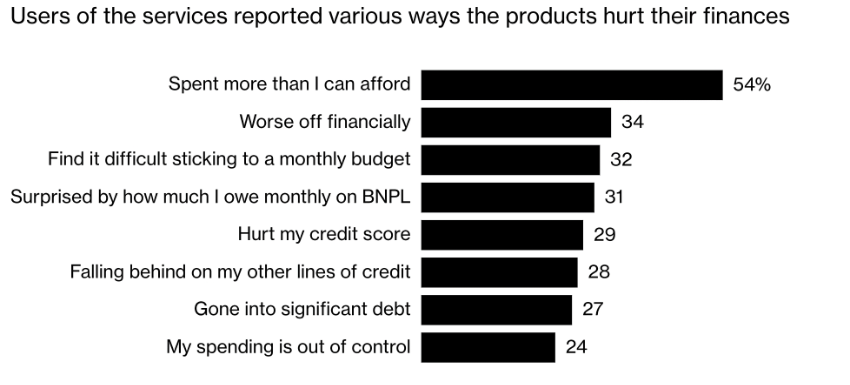

Paulina Cachero and Paige Smith of Bloomberg write on the “phantom debt” hiding on the country’s consumer balance sheet from BNPL, with 43% of consumers using BNPL services reported being behind on payments according to survey results from Bloomberg and Harris Poll.

Time and again, (BNPL providers) have resisted calls for greater disclosure, even as the market has grown each year since at least 2020 and is projected to reach almost $700 billion globally by 2028. That’s masking a complete picture of the financial health of American households, which is crucial for everyone from global central banks to US regional lenders and multinational businesses.

There are signs that consumers are struggling to afford their BNPL debt, too. A recent survey conducted for Bloomberg News by Harris Poll found that 43% of those who owe money to BNPL services said they were behind on payments, while 28% said they were delinquent on other debt because of spending on the platforms.

For (economist Tim) Quinlan, a major concern is that economic experts are being “lulled into complacency about where consumers are.”

In related news, the CFPB issued new rules interpretations this week classifying some BNPL providers as “card issuers” under Reg Z, with some caveats:

Lenders that issue digital user account to access BNPL credit are subject to the regulations appearing in subpart B of Regulation Z, including, most importantly, provisions governing credit card dispute and refund rights. Although subpart B is labeled “Open-End Credit,” 12 CFR 1026.2(a)(17)(iii) specifically states that subpart B also applies to credit that is not open end if, as with BNPL, the credit is not subject to a finance charge and is not payable by written agreement in more than four installments. …

Lenders that issue digital user accounts to access BNPL credit are generally not subject to the credit card regulations appearing in subpart G of Regulation Z (e.g., penalty fee limits and ability-to-repay requirements).

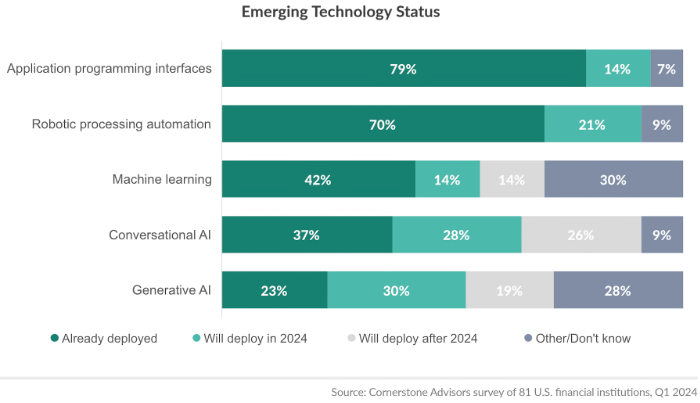

2. $780,000 of Digital Investment for every $1B in assets

Ron Shevlin of Cornerstone writes on their 2024 Digital Banking Performance Metrics research. Most alarming in their report is despite this investment, community banks and credit unions are still lagging in productivity gains, DAO rates, and overall lack of billpay and P2P payment offerings.

Community banks and credit unions continue to make ground in innovation, specifically investing in:

The report nets out the biggest barriers to performance for smaller FIs:

Digital is more than a channel. Banks’ investments in digital are no longer strictly about customer access and support—increasingly they’re about internal productivity improvement. This is causing budgeting and prioritization issues in a lot of financial institutions as the “digital banking department” struggles to balance competing demands from the organization.

Digital products are lacking. Fintechs and digital banks are dominating new checking account openings—in the first half of 2023, these companies accounted for 47% of new accounts opened, up from 36% in 2020. Why? Not because they’re digital, but because they offer a better digital product. Banks need to reinvent—or at least redesign—their core checking and payment accounts to meet consumers’ changing needs and expectations.

Digital banking platforms need a refresh. Banks’ digital banking platforms have made huge improvements over the past 10 years, but a refresh is required to enable better integration with third-party applications, provide bank execs with better insights on user activity and trends, and integrate emerging AI-based tools and capabilities.

And that’s it for this week. You may be a fan, but is your horrifically bruised face on a Topps card? Click below to let us know how we did: