This week, we look at deep survey data on commercial payments and banking’s opportunity in the face of growing competition. Also, the struggle facing the FDIC and Fed with oversight. And finally, what do you expect your marketing to do for your institution?

1. Payments under attack

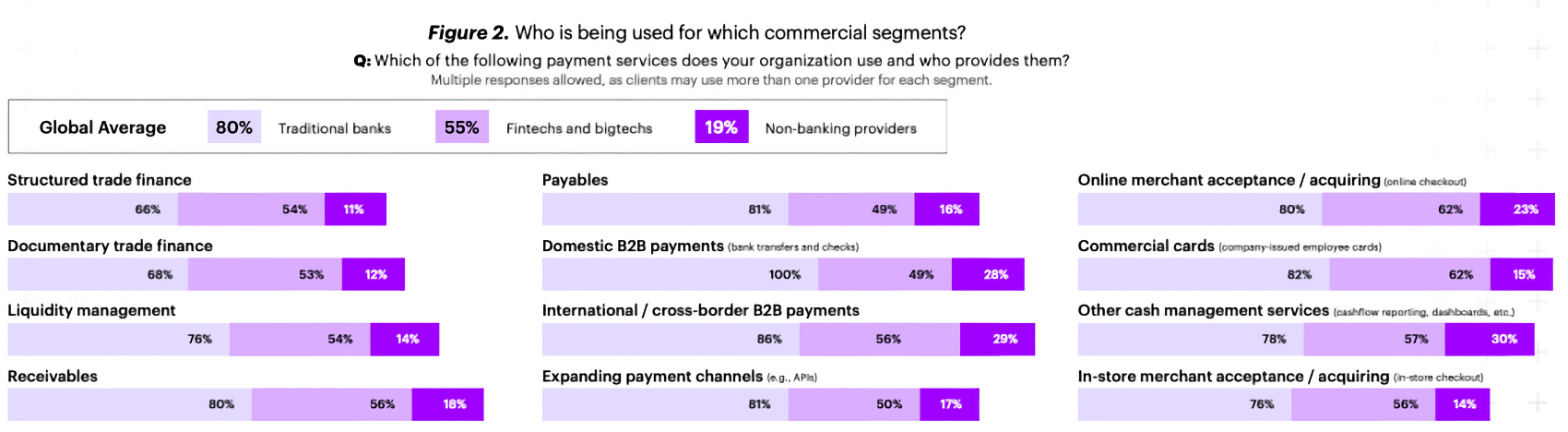

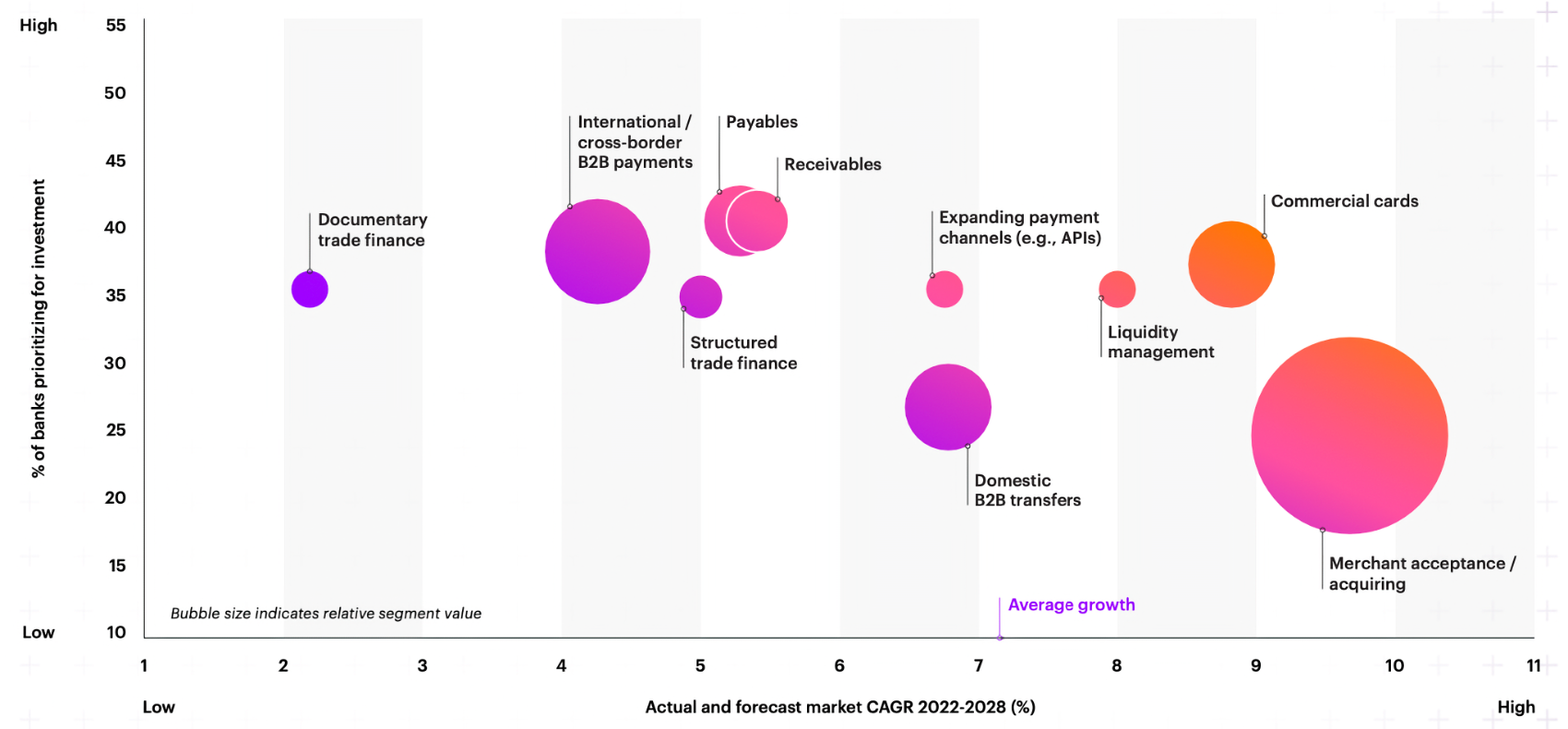

Accenture this week released a report looking at the rising competition and risk in commercial payments. In-depth survey results point to missed opportunities for traditional banks with their commercial clients.

We found significant client demand for value-added services that most banks are not effectively addressing. We also found that, on average, clients are willing to pay 8.1% of their annual payment costs towards value-added services. This could represent $371 billion in value over the next five years.

Value-added services are a powerful way for incumbents to differentiate themselves in the market. The possibilities are almost endless. Our research found strong demand among clients for many such services, including tax or accounting system integration, real-time access to payments data, and advanced data dashboards to track sales, products, and customers.

Our survey found that incumbents that fail to address these pain points may lose clients. Half of commercial payments clients that are dissatisfied with their current receivables provider said they are very likely to switch to another; 46% said the same regarding their current payables provider. Four in 10 clients that use domestic B2B payment or online merchant services are also very likely to switch to a different provider.

2. Nobody wants to be a bank examiner anymore

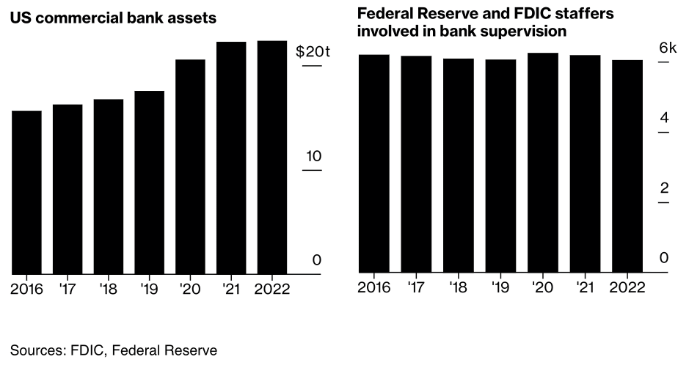

After the bombshells of reports of discrimination and harassment at the FDIC, Bloomberg reports on the growing crunch in staffing at several banking regulators.

The Federal Reserve and Federal Deposit Insurance Corp. are struggling to hire bank examiners and retain the veterans. Fed supervision staff shrank 3% last year from 2016, even as commercial lenders’ assets surged more than 40% to roughly $22 trillion. At the FDIC, more than a third of the agency’s risk-management employees will be eligible to retire by 2027, up from 18% in 2022. Resignations among its examiners-in-training in the past two years occurred at rates greater than before the pandemic.

In addition to recruiting, many veteran examiners expressed frustration at the failure to intercede before banking failures earlier this year.

Under Randal Quarles, who served as the Fed’s vice chair for supervision until late 2021, suggestions to downgrade banks’ so-called CAMELS ratings were overruled, and recommendations to bring enforcement actions against supervised lenders were repeatedly vetted, then ultimately rejected by the board, said the official, who asked not to be identified.

3. What is Marketing’s Job?

Seth Godin writes a short piece on The Head of Marketing, dissecting what is often the gulf between what’s needed and what gets done.

It’s easy to be confused about this job, because it’s not one job, it’s at least three.

This is why it’s a difficult job to fill and why turnover is so high–we’re not allocating resources or setting expectations in a way that matches the work to be done.

Marketing strategy: This is the work of positioning, story telling, status and affiliation. It’s understanding network effects, the user experience, and the change we seek to make. Good marketing strategy overcomes just about everything else.

Promotion: This is more tactical. It’s coupons and PR and perhaps advertising. It’s steady permission marketing, a thoughtful content strategy, and a team of people who consistently and generously tell your story. This is what many people think of as marketing, but while it needs to be consistent with the strategy, it’s a different set of skills and activities.

Sales support: In many organizations, the main role of marketing is to support the work of the sales team. This integrated role feels very different from the typical brand marketer’s job.

When the CEO says she’s looking for marketing help, it’s probable that what seems to be missing is promotion. But without the other two elements, not much is going to happen.

That’s it for the week. With Christmas around the corner, look for the latest trend in letters to Santa with “All I Want for Christmas Is Clearly Detailed in My PowerPoint Presentation”.

How’d we do this week? Let us know below: