For this Friday, we look at whether there is a future for the humble ACH transaction to encompass billing and invoicing. Also, an infographic analysis of the massive 2023 profit (and debt load) of behemoth JPMC.

1. Making ACH more valuable

Ayo Kunle, Cash App veteran, looks at the potential for ACH to disrupt the billing industry

Over the last 2 decades, payment innovations first optimized speed, and now cost Roughly speaking, innovations in payments over the last 2 decades optimized speed.

These innovations have sometimes traversed only the messaging layer, sometimes the moneymovement layer, and sometimes both, but the objective has been to ensure that the recipient of funds has access and is able to use their funds earlier than previously possible.

Many payments have actually a wealth of metadata that “wants” to be communicated along with the payment.

For example, when companies are paying vendors or suppliers, itemized invoices are typically exchanged over email, and payment is executed by ACH, check, or wire.

For healthcare claims in the US, payments are typically via ACH or check, and claims data is typically via 835/837 files. In consumer payments, receipts are exchanged via text, email, physical paper or your app, but payment is executed by card (or paypal or whatever payment network the consumer chooses). The opportunity here, if the messaging layer had more bandwidth, is to include the metadata inside the payment instructions directly. There’s a variety of benefits to doing this. Among others . . .

- You could authorize directly on specific items, rather than on the whole payment

- You could automatically reconcile payments against their purpose, rather than relying on parallel systems to do so

- You could explicitly include post-payment context (eg this payment is HSA/FSA eligible, this payment is eligible as a childcare savings payment, 30% of this payment is a tax deductible business expense in category X, etc)

More on the idea, and who would need to be involved in the whole article. However, the concept of moving adjacent to the movement of money is compelling. Look at Autobooks.co, which provides simple invoicing and payment management for small businesses as an add-on to their banking account. Simplifying the life and reducing costs of the small businesses that are overrepresented in community banking is a potential for significant growth and stickier customer relationships.

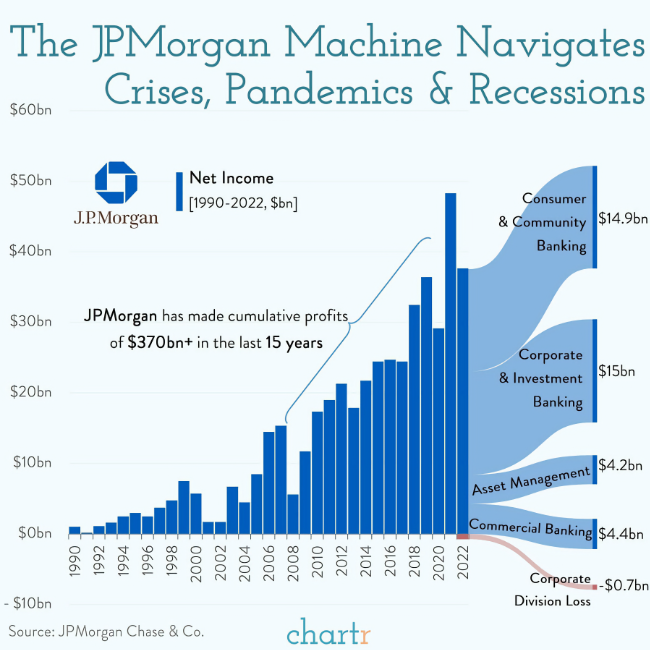

2. JPMC’s record year

David Hollerith of Yahoo Finance reports:

The largest lender in the US reported Friday that it raked in a record $49.6 billion in annual net income, the most ever in the history of the American banking industry. And it happened during a year that was the scariest for the industry since the financial crisis of 2008.

That result — buoyed by better loan margins and the acquisition of failed regional lender First Republic — was 31% better than its bottom line in 2022.

It blew away all rivals. JPMorgan’s annual net income surpassed Bank of America by $23 billion, Wells Fargo by $30 billion and Citigroup by $40 billion.

A related analysis from Business Financing takes a look at the global bond market, including the largest debt loads by country and industry. JPMC here as well takes center stage:

And that is it for this Friday. A great take from Moneyball, The Blind Side, and The Big Short author Michael Lewis, “Don’t Eat Fortune’s Cookie.”.

One last thing, we’re launching a new podcast by and for Community Banking Leaders. It’s called Behind the Vault: Conversations with Customer-Driven Bankers. If you or someone at your institution would like to be highlighted and share your story, apply here -> podcast.mindspaninc.com/podcast-guest.

Click below to let us know how we did: