To wrap up this last Friday (practically) of the year, here are a few of the stories that didn’t quite make the list for the weekly round-up, but are definitely worth your time.

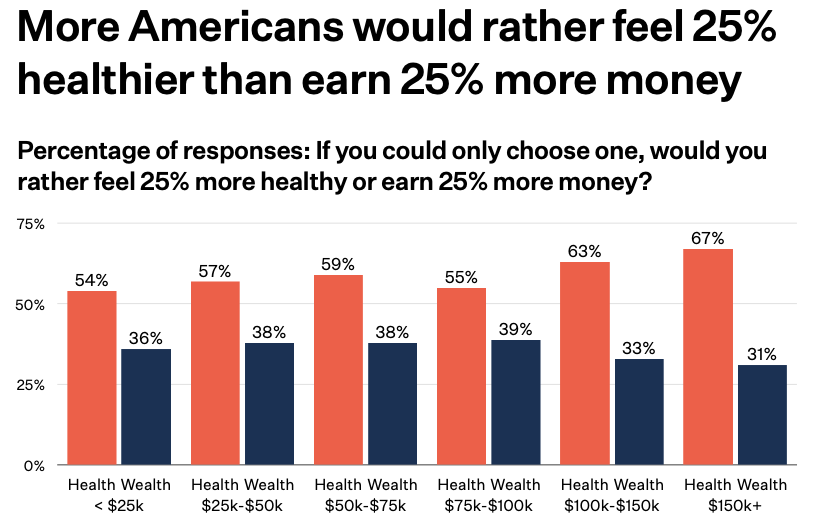

1. Consumer sentiment up, healthcare takes centerstage

Dan Frommer of New Consumer has published his end of year Consumer Trends report.

In addition to their always excellent consumer sentiment research on the economy, jobs, and interests, Frommer and team look at emerging trends like interest in emerging weight loss drugs.

Around 8-15 million Americans are currently using GLP-1 drugs to manage diabetes or to lose weight…

86% of GLP-1 users say they feel like a different person, with the most positive among users who have been on GLP-1s for 6 to 11 months.

2. FedNow crosses 300 participating institutions

The Federal Reserve reports that 332 participating institutions are now enabled for FedNow real-time payment capabilities.

Among those leveraging the new capabilities to enhance their business model is Citizens Financial Group, which has enabled partner Credit Acceptance Corp and its network of 10,000 auto dealers to receive real-time payments for auto loans origination up to six times a day.

Likewise, Veridian Credit Union of Iowa is leveraging FedNow to streamline its mortgage business with faster loan payoff and closing cost settlement.

3. Getting attention from the boss at a $400B company

Andy Dunn, founder of clothing company Bonobos, shares what he learned working for Doug McMillion, CEO of WalMart, after the retail giant acquired Dunn’s company in 2016. First on his list is his listening skills in meetings.

“Doug is a magician,” Dunn said, “his communication skills are outrageous.”

Strong eye contact with zero distractions. “He zoned in when someone was talking.”

McMillion sent detail notes on his employee’s decks or presentations. McMillion asked meeting presenters to submit their slides in advance so he could read them. After the meeting, McMillion gave the presenter thoughtful notes on each slide, showing them he understood their perspective and cared.

“Whereas when I ran Bonobos,” Dunn said, “I wouldn’t even look at the deck until the meeting. And I never gave notes.”

But McMillion taught Dunn to recognize that when your employees spend weeks on a project, showing respect by reviewing their work before a meeting means a more productive conversation and loyalty.

4. The wisdom of Charlie Munger

This month, the legendary investor and principal partner of Warren Buffet at Berkshire Hathaway, Charlie Munger, passed away at the age of 99 (just over a month before his 100th birthday).

Known for his often folksy wisdom, Charlie was a prolific reader, philosopher, and champion of “mental models” for decision-making.

Of his many acolytes are Patrick and John Collison, founders of payment fintech Stripe. As part of their publishing imprint Stripe Press, they worked with Munger and co-author Peter D. Kaufman on a revision and reprint of Munger’s classic Poor Charlie’s Almanac.

The book includes Munger’s famous speech The Psychology of Human Misjudgment, revised and updated by Munger before his passing.

We should also remember how a foolish and willful ignorance of the superpower of rewards caused Soviet communists to get their final result as described by one employee: “They pretend to pay us and we pretend to work.” Perhaps the most important rule in management is “Get the incentives right.”

I highly recommend this interview John Collison did with Munger late last year

And that’s it for this unofficial final Friday of 2023. And you thought PowerPoint was a pain today to deal with today? Click below to let us know how we did: