What Ad Networks and Ad Tech Do Community Banks Rely On?

(And how does the size of the Financial Institution change the answer?)

US financial services spent over $23.5B in digital advertising in 2021. Digital now accounts for more than 50% of all advertising spend. These outlets are rapidly forming a larger concentrated marketing and growth cost for financial institutions of all sizes.

But how does community banking as a sector employ these dominant channels for customer acquisition… and do alternatives exist at all??

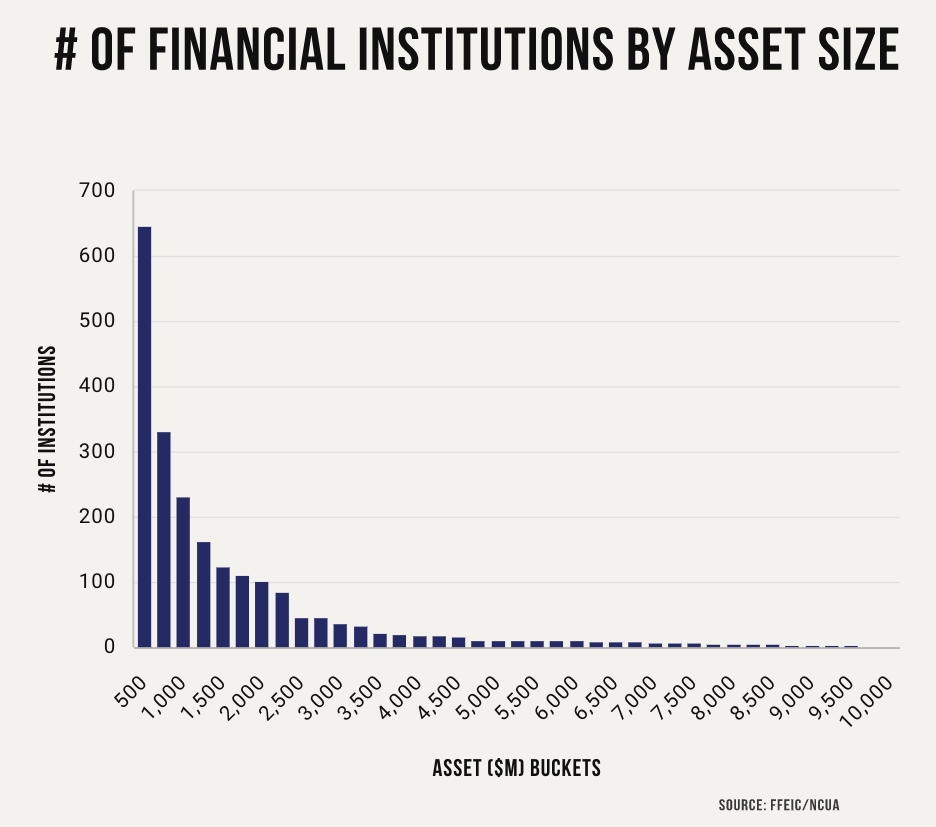

We examined the ad networks and tracking technology for over 2,000 community banks and credit unions, with 2021 year assets between $500M and $10B. (FFIEC, FDIC, NCUA). This mimics the Federal Reserve Bank Holding Company Performance Report peer classification groups 04, 03, and 02.

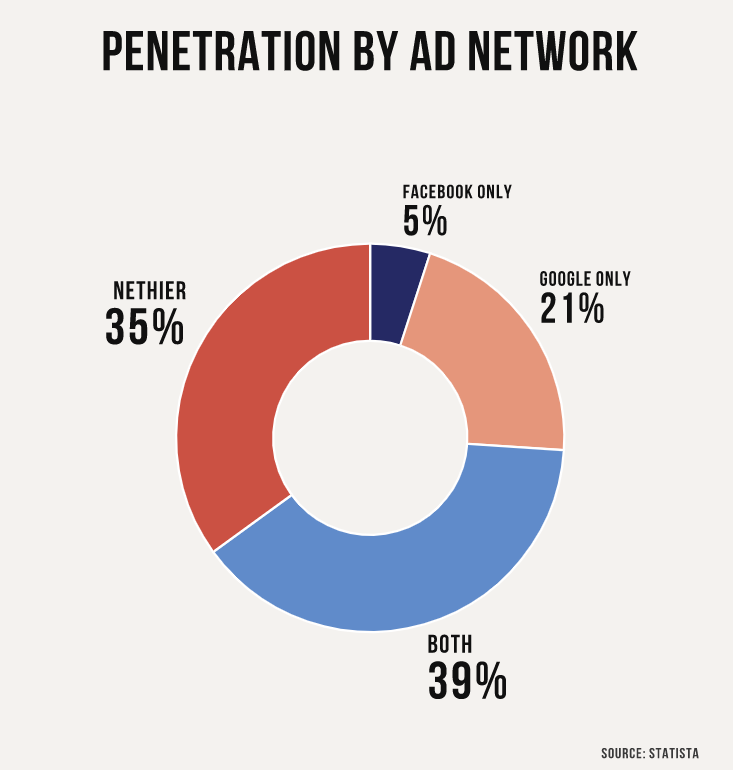

Overall from a revenue standpoint in the US, Google remains the leader with 29% of share net digital ad revenue, slightly ahead of Facebook (including Instagram) at 25%.

In comparing relative use by FI's, Google similarly leads with a presence in 60% of community institutions, with 21% leveraging Google only and 39% using both Google and Facebook networks. Facebook is present in only 44%, and a very small minority of 5% relying on Facebook alone.

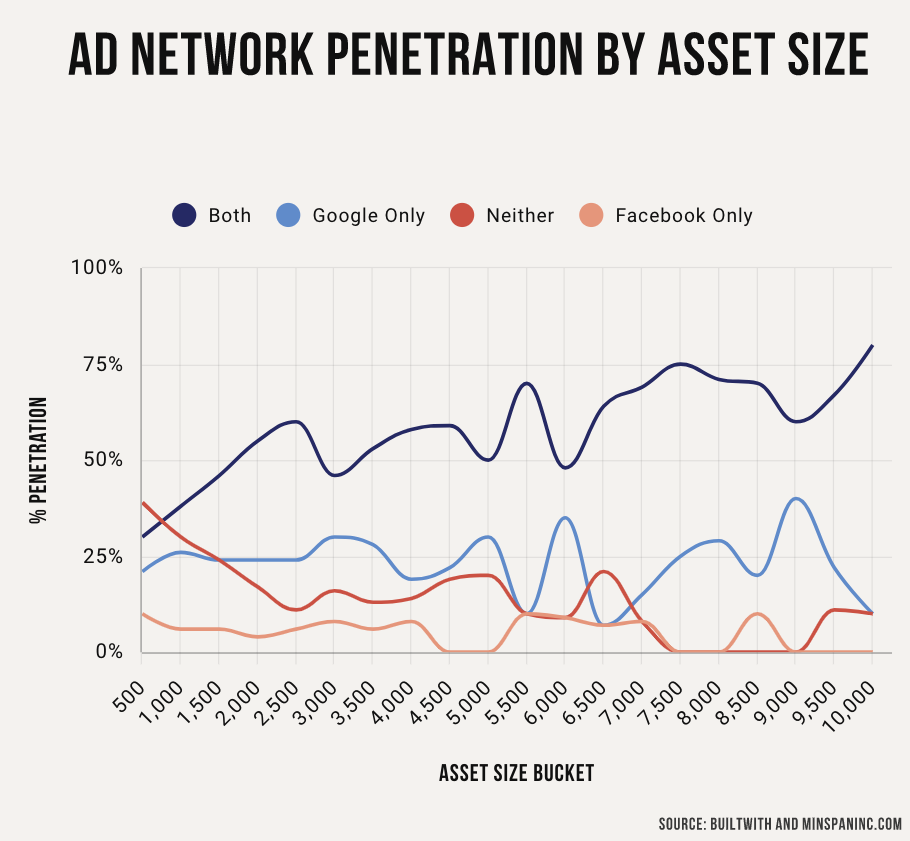

The story changes dramatically, however, when factoring in the size of the institution. The rate of FI's using both ad networks more than doubles when approaching the upper bound. In this tier of the largest FIs,either category drops close to zero.

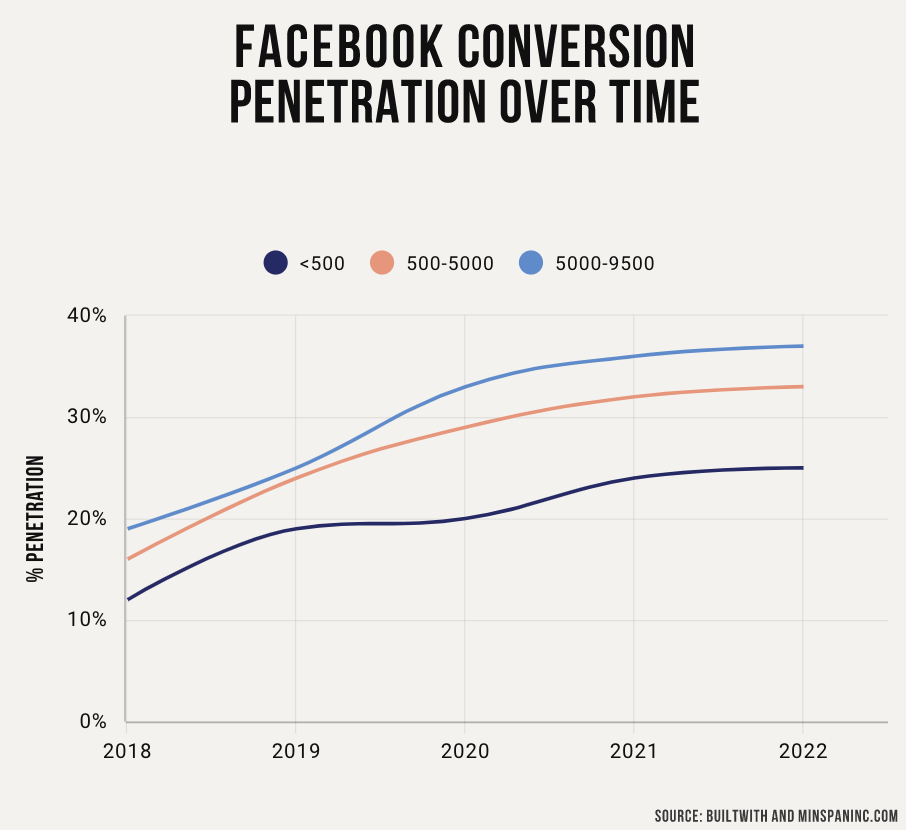

Not only are digital ad networks more prevalent with larger FI's, bigger institutions also customize their tracking and conversion measurement at higher rates. Typical of this are larger institution increased likelihood to customize Facebook's conversion tracking and incorporate more advanced customer experience measurement. This gap in utilization has accelerated in the past 4 years increasing the spread between larger and smaller FI's

Complicating the dominant strategy is the growth in ad blocking, technical restrictions of 3rd party cookies, and increased regulatory restrictions like GDPR and CCPA. With 48% of all website traffic on mobile devices and rapidly growing, similar policies like Apple's ATT combine to make the direct measure of impact difficult. This is immediately evident in the effect of Facebook's revenue. Alternatives to client-side tracking technology need to be examined for augmentation or replacement to improve your ability to personalize your customer's experience.

So what can we make of this?

- Takeaway 1: Like their relative investment in innovation in general larger institutions are outpacing their smaller competitors. Surprisingly, this isn't a constraint of either know-how or large investment. Leveraging capabilities like customer audiences or custom conversion events only requires incremental effort and time over configuration.

- Takeaway 2: There is an emerging, less crowded opportunity with 3rd party demand side platforms like The Trade Desk and Simpli.fi. With a lower share of ad spend, and additional outlets like connected TV and podcast placement, DSP's present a way for smaller FI's to standout from the crowded markets.

- Takeaway 3: Client side tracking will become increasingly difficult and less informative. Consider where the opportunities are to better understand the customer's journey inside your own funnel and instrumenting appropriately. Server side and enhanced mobile app instrumentation is worth exploring for the additional insight it can provide.

Beyond ad networks, most marketers rely on over 23 tools in their tech stack to attract and retain customers. Creating a competitive advantage first means pulling it together, breaking down silos, and having a holistic view of your customer's experience. It may seem a time consuming effort, but it will help your team to focus on the customer, more personal and more responsive to their needs. This responsiveness is fundamental to staying ahead. If your team spends most of their time in spreadsheets moving data around, with little to no insight to show for their efforts, it's time to give us a call.