Why was today the day your customer or member opened a new account? Or applied for that loan?

What was going on in their life that made today the day?

Asking this question and finding the answer is key to understanding what “job” your financial product is being “hired” to do for your customer.

While a funny idea, someone “hiring” a product to do a “job”, this concept is the core of the Jobs-To-Be-Done Framework (JTBD). Developed by Clayton Christensen, the Rewired Group’s Bob Moesta, and others, the main idea of the work is to provide insight into the motivators behind any action, but in particular, product or solution purchases.

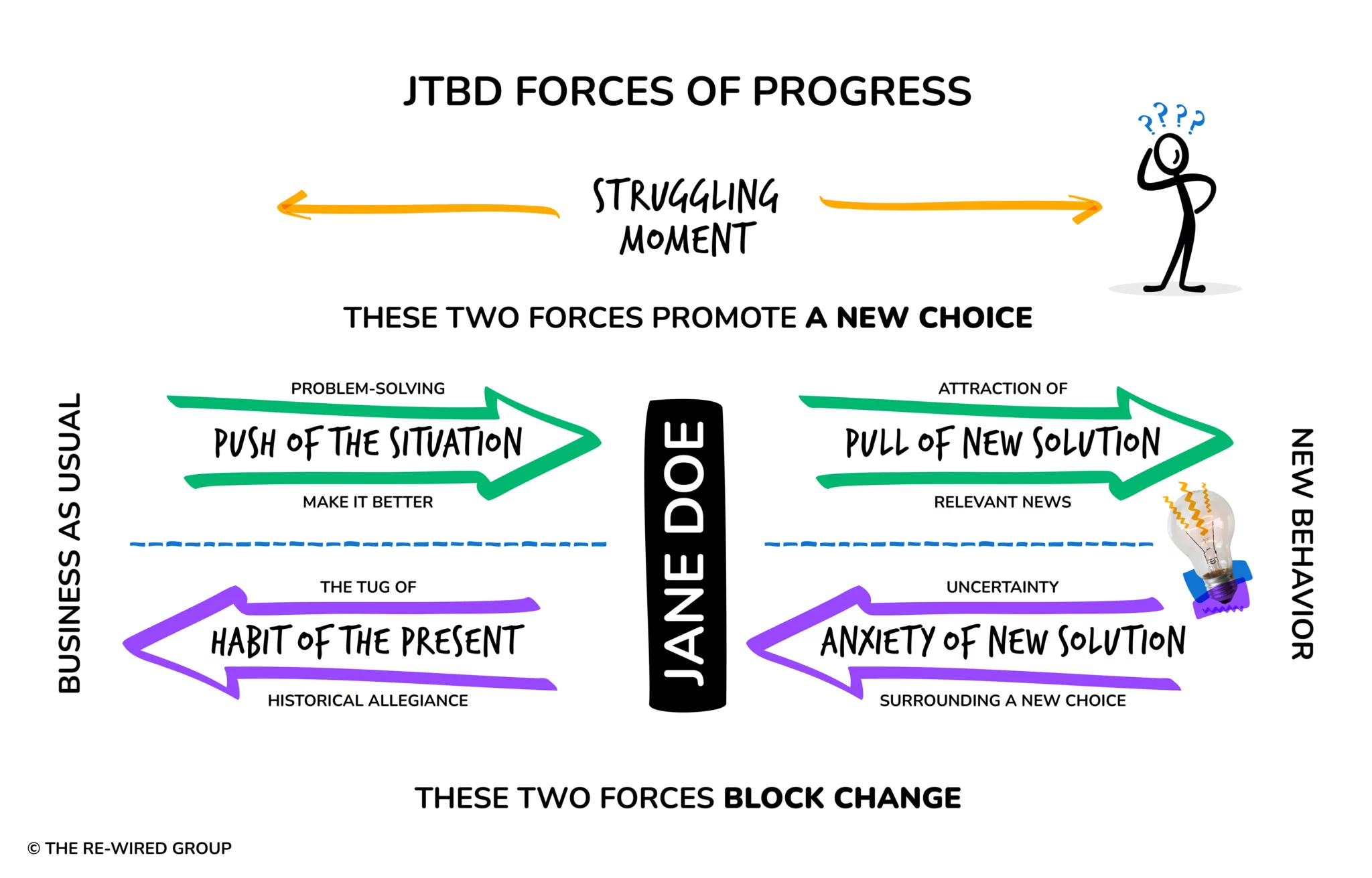

A key concept is to identify the “struggling moment,” or the gap in a person’s life, and the forces that promote or prevent a choice to make a change.

While a seemingly simple concept, there is a lot of depth to the process and insights from this analysis. However, there in one very important idea to keep in mind.

If there’s no push or pain of the status quo in your customer’s life, you and your solutions are invisible.

Community financial institutions deal in the currency of trust, even more than the actual numbers on the balance sheet. That trust is built on the personal service levels you’ve provided for years, decades, or even centuries. Using a tool like JTBD can draw you even closer to your customers and members and point the way to even more relevant offerings and experience.

Read more here, including how-to’s and references to get started.