In Morning Consult’s 2022 Most Trusted Brands survey, consumers were asked about their interactions with brands across the spectrum. When it came to factors influencing their level of trust and where they place that trust, banking and financial service uniquely stood out:

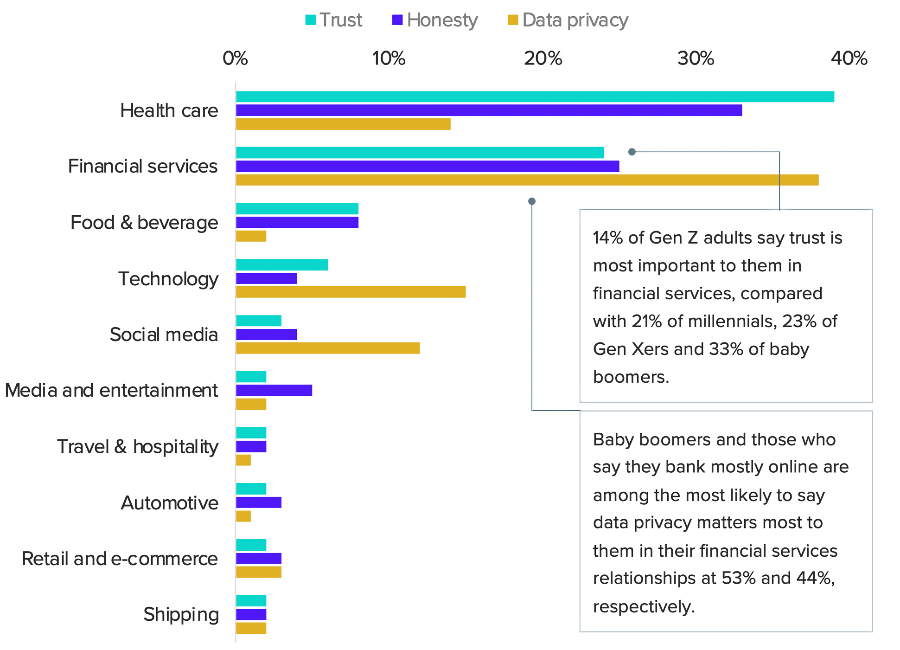

Trust and data privacy are the pillars of financial services relationships. To consumers, trust, honesty and data privacy matter more in financial services than in almost any other industry.

There are high stakes for financial services brands. When consumers lose trust in financial services companies, they don’t give second chances.

More than any other industry, 29% of consumers indicated they would never do business with a financial services company that broke their trust. Only 17% indicated they would consider giving that company a second chance.

When asked about factors that caused them to lose trust in a financial service company and stop doing business with them, 48% indicated it was bad customer service. The only other consideration to come close was product quality decline. Price, ESG, public scandals, and PR missteps all pale in comparison.

How your customer feels interacting with you and your financial products and services is the whole game. You can lose badly by dropping the ball, and you can take a lot of share by standing out in the minds of your customers.

Consider this a prompt to consider where you’ll focus to gain a competitive edge. Is it geographic expansion? More brand awareness advertising like venue sponsorship? Is it in the level of personalization you can incorporate into your experience and offerings? As most organizations enter a planning and budgeting period for next year, where are you making big and small bets for next year?

Given the uncertainty you’re dealing with in the coming year and the current upheaval in privacy and digital advertising, are you sufficiently testing the limits of what you know and only think you know? Renowned poker champion and sought-after business consultant Annie Duke’s fantastic book Thinking in Bets captures this sentiment:

The decisions we make in our lives—in business, saving and spending, health and lifestyle choices, raising our children, and relationships—easily fit von Neumann’s definition of “real games.” They involve uncertainty, risk, and occasional deception, prominent elements in poker. Trouble follows when we treat life decisions as if they were chess decisions.

Next year won’t be like this year. Are you planning and allocating budget as if it will be?