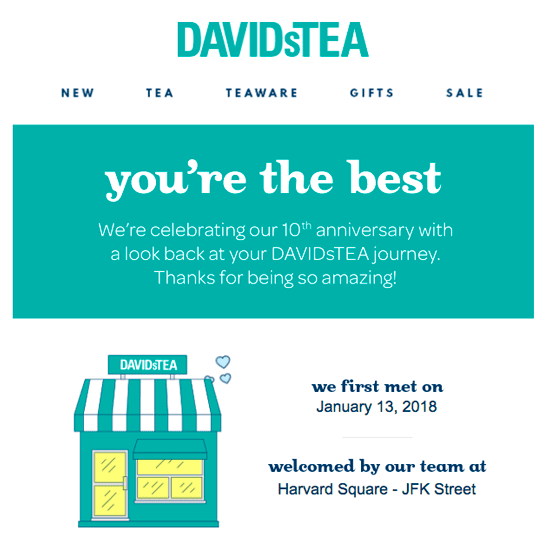

The above image is from Canadian specialty tea seller DAVIDsTEA. As part of their loyalty program, they send emails like this to their best customers.

Your customers’ connection with your institution can be strengthened through such opportunities. And the impact of talking to your customers in a personalized way is often the effort needed to pull it off.

Personalized communication requires creating segments based on behavior. Not demographics but what your customers and prospects do and how they interact with you.

Whether just using a simple rules-based approach or a more complicated automatic creation of segments

The point is to identify critical points in your customer’s or member’s journey. Once identified, it is about ensuring that proper action or communication is made.

This is key for one of the more common current tactics for community banks and credit unions to retain deposits. Inquiring about plans for customers making large withdraws can give a chance to counter or point out competitors’ fine print gotchas of limited-time offers.

Personalized communication sets your institution apart in today’s competitive landscape, where customers are constantly bombarded with generic marketing messages. It helps you build a deeper understanding of your customers, fostering a sense of loyalty and satisfaction that drives long-term success. By leveraging customer behavior data, you can forge stronger connections with your customers and prospects, leading to increased engagement, customer satisfaction, and business growth.