This post is the 2nd of our series on building personalized banking experiences for your customers.

The alignment of data to customer experience is an essential first step to personalization. It can also lead to revolutionary results.

USAA historically assigned separate product groups to manage its various offerings. For example, when a customer purchased a car, one group would help secure financing while another helped with insurance. The process worked, but USAA’s leaders believed the company could do a lot better. Following the digital natives’ lead (like Warby Parker and Stich-Fix), USAA now organizes around customers, with employees from different product lines and functional groups working as a team to address an overarching customer need. People seeking to buy a car can choose and locate the best model, negotiate its purchase, and finance and insure it as a seamless experience. Customer-needs-based objectives sit alongside product and operational goals; success is measured across key outcomes such as customer satisfaction, loyalty, and product sales.

Beneath the organizational and strategic impacts of this story are a few lessons.

The combination of auto loans and insurance user experience may seem obvious. Removing a breaks in flow or delays to the customer pays off. This is true whether joining adjacent experiences, or streamlining new customer onboarding.

But, the effort to create a winning user experiences like this requires the combination of data and process. The impact on the customer, and the bottom line, only comes after the hard work of designing an equally seamlessly foundation.

Three key areas to shape your efforts at this first stage:

-

Take stock: What data are you currently collecting? Do this from your customer’s perspective. Does every touchpoint have at least one measured aspect of the experience? Is it a direct measure or proxy for success (again, from a customer’s perspective)?

-

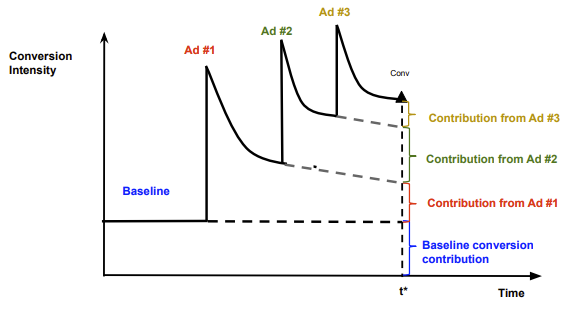

Attribution: Can you measure where customers are coming from? Again, perfection is not the goal. But you need to understanding every time your customer comes in contact with you. There are many ways to combine this data. , but is there an event you can assign to that contact at this step?

-

Governance: This is about making the right data, and only the right data, available to the right people at the right time. It’s not only about compliance. You can ensure perfect compliance by locking up data so no one can use it. This situation leads to workarounds and shadow data sets created out of desperation. To be successful, you must have a coherent plan and process for collecting, storing, protecting, and making it available to those who need it.

This step is about being able to generate answers. The data determine the limits of the scope and specificity of those questions. You will revisit this step later when you hit those limits. For now, understand what you have on hand.

Next, we will be connecting the dots in the context and data. This step is where the insights, and the real unfair advantage in this process, come from.