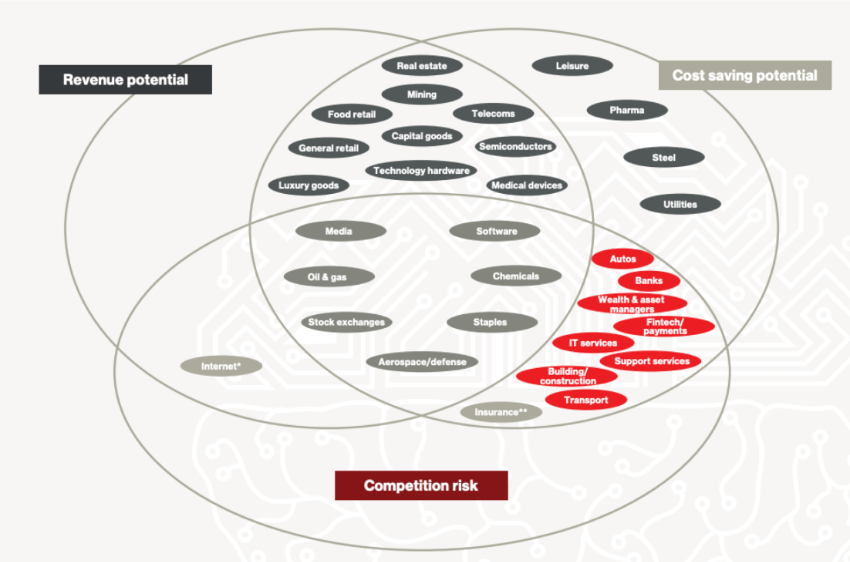

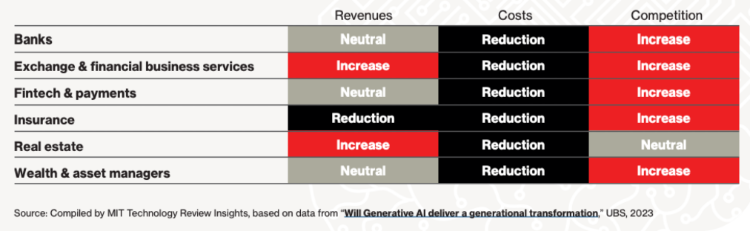

MIT’s Technology Review, in partnership with UBS research, recently published a report looking at the potential risks and opportunities of generative AI (like ChatGPT) for financial services.

The report’s central thesis is that the financial service industry, particularly banking, will most likely benefit from staff productivity.

Generative AI’s main opportunity for the financial sector is lower costs, as staff expenses represent a relatively high portion of total costs.

These savings, in most cases, arise from using technology to free human employees from the need to analyze large amounts of often unstructured data* and to produce output in response to directions given in natural language.

Additionally, risks and barriers to adoption are widely the same:

- Legacy technology, and the ability to quickly incorporate new solutions

- Talent availability, particularly development and implementation

- Regulatory risk, an emerging topic and one that makes it easier to delay any new initiatives

While all of this is broadly applicable, what is missing from their analysis are the differences in institutions’ size and especially how opportunities are not as similar.

The analysis assumed value will be captured by doing the same things, only slightly faster and cheaper. This is true for large industrial-scale banks, constrained by rigid processes and business models.

However, this leaves a massive opening for community banks and credit unions to amplify their service level focused business model. Smaller institutions that rely on more human-driven and personal service can more heavily leverage generative AI and drastically increase their connection and engagement with customers.

Hyper-personalized customer experience is possible at every touch point today.

Imagine that everything your customer sees from you was created specifically for them, for their situation, with their individual needs in mind. Equipping your customer-facing teams with the insight and empathy of your entire organization’s knowledge and experience can empower even new employees to provide your stand-out tailored service.

So, for you, the community banker, MIT and UBS missed the mark. Your unique opportunity can draw your customers closer in a way that’s much harder for larger institutions to pull off.

In closing, the trend and place to look is best summed up by John Mileham, Chief Technology Officer of Fintech firm Betterment:

“As of yet, it’s not like you’re going to be putting a generative AI directly in front of customers and setting it free… we’ve seen people wanting more human interactions for retail transactions instead of fewer.”

*Unstructured meaning any data not in tables and row, like databases and spreadsheets (i.e. written procedure documents, images, charts, audio, video)