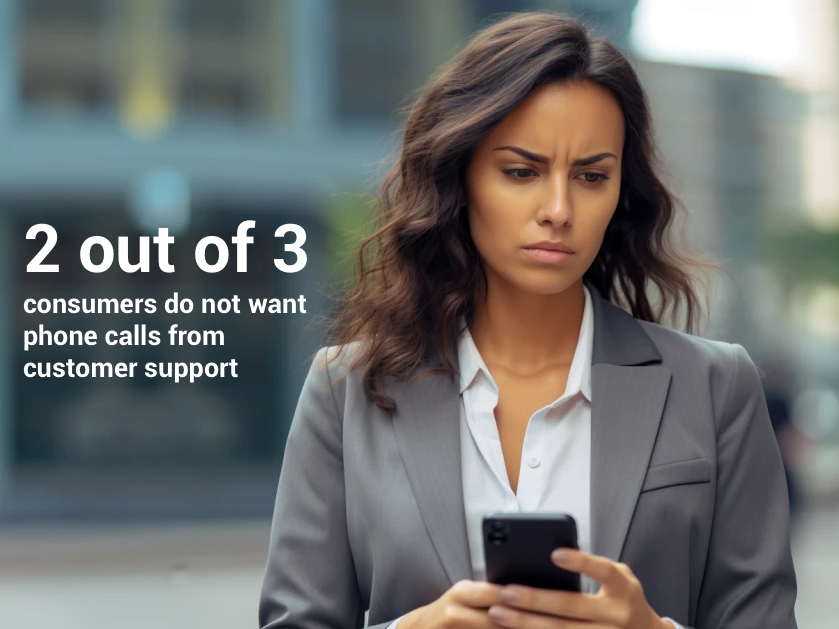

The above stat underlies industry trust and customer satisfaction. The rapid growth of complaints made to the National Do Not Call Registry tells that story.

But to make this personal, have you ever texted someone only to have them call you back? How did that make you feel?

Customers responding to digital ads and direct marketing expect a digital experience.

Point a spotlight at any process or fulfillment of a new service that requires a phone call or, god forbid, an in-person visit to a branch.

DAO can’t solve every situation. If you must interrupt a digital experience, make it as late as possible. The investment in time with you (aka the sunk cost fallacy) and any trust built along the way can reduce that friction.

But remember, 40% of customers will stop doing business with you after a poor customer service experience.

If you struggle with providing a smooth experience between marketing and operations, give us a call. We specialize in helping community banks, and credit unions personalize their customers’ experience and stay ahead of the competition.